July was a good month to be a seller in the Wine County, with median home prices reaching yearly highs in Napa County, Sonoma County, and Sonoma Valley. Prices for single-family homes remained above $1 million in Contra Costa County, Marin County, and the Mid-Peninsula region, while properties in our Silicon Valley region continued to command about $2.5 million.

The supply of homes on the market remained scarce in almost all of our Bay Area regions, particularly in the East Bay, where the months’ supply of inventory (MSI) tied its yearly low. And homes in the most-coveted regions continued to fetch premiums, in some cases as much as 10 percent more than original price.

Click on the image accompanying each of our regions below for an expanded look at real estate activity in July.

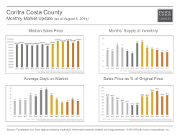

CONTRA COSTA COUNTY

After taking a slight dip in June, the median sales price in our Contra Costa County region was back above $1 million in July. Homes stayed on the market for exactly three weeks, identical to levels observed one year ago.

The MSI, which has been steadily declining since February, was unchanged from June, at 1.4. On average, Contra Costa sellers received a smidgen above asking prices in July, which was also the case in the preceding month.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Danville, Diablo, Lafayette, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the adjoining chart includes single-family homes in these communities.

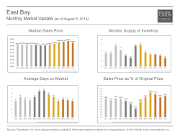

EAST BAY

The East Bay’s inventory woes continued in July, with the MSI tying its one-year low of 0.9. Because of the limited housing stock, buyers faced stiff competition and therefore ended up forking over about 10 percent more than asking price, on average.

Buyers did get some relief on another front, with prices dipping below $800,000 for the first time since early spring. But shoppers in the East Bay needed to move fast to score a home, as houses sold in an average of 20 days, which matches a one-year low.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the adjoining chart includes single-family homes in these communities.

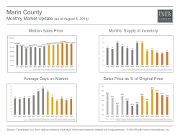

MARIN COUNTY

Median prices in Marin County climbed above $1 million in March and haven’t backed down since. July’s median price of $1.05 million is almost exactly the same as it was in June.

The MSI expanded slightly from the previous month to 1.6, and homes took a bit longer to sell – an average of 51 days. Buyers paid 97 percent of asking price, which is similar to levels we’ve seen for the past few months.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the adjoining chart includes single-family homes in these communities.

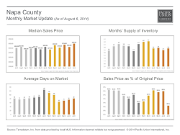

NAPA COUNTY

At just shy of $600,000, July’s median sales price in Napa County reached its one-year peak. The MSI increased to 3.4 but is in the same general range it has been since the spring.

Buyers got a little extra breathing room in terms of market velocity, with the average home selling in 82 days. Homes sold for just 88 percent of original price, the lowest percentage of asking observed in any of our regions in July.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the adjoining chart includes all single-family homes in Napa County.

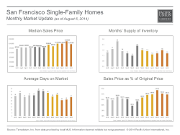

SAN FRANCISCO – SINGLE-FAMILY HOMES

The median San Francisco single-family home price fell month over month in July to $1.07 million, but it was the fifth month of 2014 where prices have exceeded $1 million. The MSI declined from June to 1.3, identical to levels recorded in May.

San Francisco buyers had a bit more time to make a move than they did in the previous two months, as properties sold in an average of 31 days. As has been the case in every month thus far in 2014, home sold for more than asking price, this time by about 10 percent.

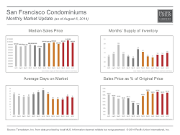

SAN FRANCISCO – CONDOMINIUMS

After topping $1 million in June, the median condominium price in San Francisco cooled off in July, declining to $965,000. The MSI expanded slightly to 1.6, the highest it has been since February.

Even with a bit of extra inventory to choose from, buyers still shelled out more than the original price to close a sale — an average 7.5 percent more. Homes left the market in an average of 33 days, similar to what we noticed in the preceding month.

SILICON VALLEY

Home prices in our Silicon Valley region have hovered around $2.5 million since the beginning of the year, and July’s median price of $2.43 million is a barely noticeable uptick from June. Sellers received premiums of about 2 percent more than original price, the smallest in the past few months.![]()

At 1.3, the region’s MSI remains constricted and showed little improvement from the previous month. Buyers took exactly four weeks to close a deal, the longest amount of time since February.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the adjoining chart includes all single-family homes in these communities.

Mid-Peninsula Subregion

After reaching $1.6 million in May, the median home price in our Mid-Peninsula subregion has been slowing a bit and finished July at $1.38 million. Inventory conditions in the Mid-Peninsula were identical to those observed farther south in Silicon Valley, with an MSI of 1.3.

In June, homes in the region sold at a breakneck pace, but that changed in July, when buyers took an average of 33 days to make a transaction. Sellers received about 1 percent over asking price, the smallest premiums seen since February.

Defining the Mid-Peninsula: Our real estate markets in the Mid-Peninsula subregion include the cities of Burlingame (excluding Ingold Millsdale Industrial Center), Hillsborough, and San Mateo (excluding the North Shoreview/Dore Cavanaugh area). Sales data in the adjoining chart includes all single-family homes in these communities.

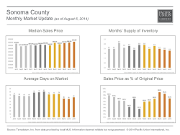

SONOMA COUNTY

The median home price in our Sonoma County region has been steadily rising since April and broke the half-million dollar milestone in July, landing at $510,000. At the same time, the MSI hit a yearly low, falling to 1.9.

Sellers took in about 97 percent of asking price, in line with what we’ve seen for most of 2014. Homes took an average of 63 days to sell, a bit longer than they did in the previous two months.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the adjoining chart includes all single-family homes and farms and ranches in Sonoma County.

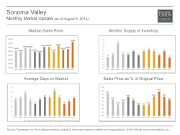

SONOMA VALLEY

The median sales price in our Sonoma Valley region rocketed up to $730,000 in July, a month-over-month gain of 31.5 percent. As in Sonoma County, the MSI dropped to a yearly low, finishing the month at 1.9.

Even with the robust price growth, the average buyer still managed to get a bit of a discount, paying about 95 percent of original price. Properties left the market in 76 days, more than two weeks longer than they did in June.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the adjoining chart refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

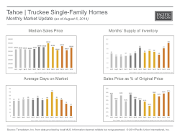

TAHOE/TRUCKEE – SINGLE-FAMILY HOMES

Prices for single-family homes in our Tahoe/Truckee region were up as the third quarter began, rising to $590,000. Buyers paid 96 percent of asking price, in line with levels recorded for the past few months.

Home shoppers in the region had plenty to choose from in July, with the MSI hitting a one-year high of 10.5. Homes in the region were also moving substantially quicker than they have in a year, with the average days on market dropping to 60.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes single-family homes in these communities.

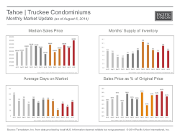

TAHOE/TRUCKEE – CONDOMINIUMS

The median price for a condominium in the Tahoe/Truckee region reached a yearly peak in July, climbing to $452,000, an annual gain of 56 percent. The MSI contracted from the previous month to finish July at 8.5

Sellers received an average of 94 percent of asking price, similar to levels observed since the spring. The average Tahoe-area condominium sold in 130 days, more than six weeks longer than in June.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes condominiums in these communities.