2012 was a blistering year for San Francisco Bay Area residential real estate, as most of our regions tallied their highest number of home sales since 2005. Back in Q2 we said jobs would drive our housing markets, and we hit the nail on the head. Exceptional job growth in San Mateo, San Francisco, and Marin counties spurred home-buying demand at a pace not seen in other U.S. markets.

Due to a limited inventory of homes for sale, we also got the most interesting dynamic of our record-setting year: the return of “bidding wars,” or multiple offers, in most markets at price points up to $1.5 million.

In 2013 we predict more robust demand, as job growth expands into other Bay Area counties. Continuing constrained inventory will create price appreciation for the first time since 2007. And if the appreciation continues through summer ’13, we will see “move-up buyers” re-enter the hunt for higher-end housing (over $1.5 million) in late August and early September.

These buyers, who have been waiting patiently for their home values to rise so they can trade up to larger residences or better neighborhoods, will contribute to additional inventory in the mid-tier markets and improved demand in the higher end.

Overall, we have a very positive outlook for Bay Area residential real estate in 2013. Whether you’re looking to buy or sell, remember that real estate is hyperlocal — and your best ally is a real estate professional who can provide you with exceptional local insight, knowledge, advice, and decision support.

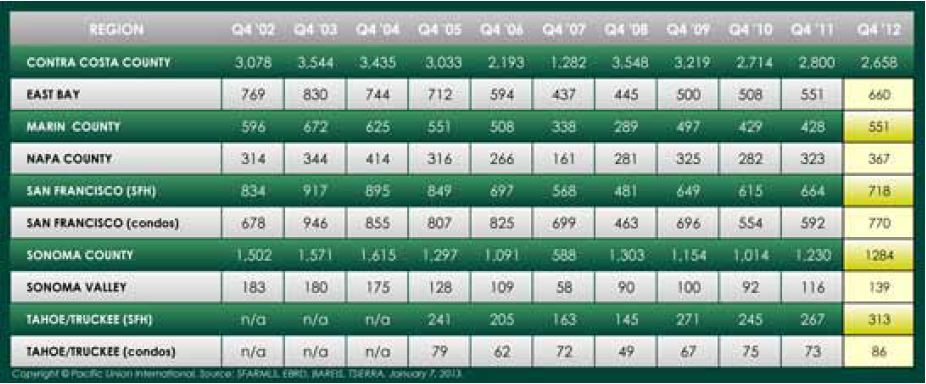

Q4 BY THE NUMBERS

Pacific Union International’s fourth-quarter Real Estate Report is packed with regional summaries and data that confirms our optimism. It also includes a feature story on luxury home buyers that we posted separately on this website earlier in the week.

Another feature of the Q4 report is a massive chart that tracks 10 years of home sales throughout the Bay Area and in Tahoe/Truckee — 66 cities, towns and neighborhoods in eight regions. A smaller version of that chart, showing regional totals, appears below. Click anywhere on the chart to see the full data set, which includes selected cities within each region.

.

Below are some specifics on what’s happening in our regional real estate markets. For full details, including detailed charts, please view our complete Quarterly Real Estate Report.

CONTRA COSTA COUNTY

Sellers were in short supply in the fourth quarter in Contra Costa County, continuing a trend we’ve seen all year. The shortage meant available homes moved fast: Those that were priced fairly and without major flaws were snapped up quickly. A balanced real estate market typically has a six-month supply of inventory available, but we had only a small fraction of that amount in the fourth quarter, and the average number of days on the market dropped considerably from the fourth quarter of 2011.

Sellers were in short supply in the fourth quarter in Contra Costa County, continuing a trend we’ve seen all year. The shortage meant available homes moved fast: Those that were priced fairly and without major flaws were snapped up quickly. A balanced real estate market typically has a six-month supply of inventory available, but we had only a small fraction of that amount in the fourth quarter, and the average number of days on the market dropped considerably from the fourth quarter of 2011.

Buyers were undeterred, however. Most homes received multiple offers, which helped push prices higher. The shortage of homes made it difficult for first-time buyers, who were often outbid by deep-pocket investors and all-cash buyers.

We saw more higher-priced homes in the fourth quarter than in previous quarters, and consequently more sales. Buyers looking for lower-priced homes had a much smaller supply of foreclosed and bank-owned properties to choose from, as banks increasingly turned to loan modifications and short sales.

Looking Forward: We expect to see a solid increase in homes coming on the market by the end of January, with a busy first quarter of 2013, and continually rising home prices. The Bay Area economy shows no sign of slowing down, which bodes well for home sales.

EAST BAY

Buyers had a limited number of homes to choose from in the third quarter of 2012, and by the fourth quarter the market got even tighter. Nearly 75 percent of sales in our Montclair and Berkeley offices involved multiple offers, and buyers had to move quickly.

Buyers had a limited number of homes to choose from in the third quarter of 2012, and by the fourth quarter the market got even tighter. Nearly 75 percent of sales in our Montclair and Berkeley offices involved multiple offers, and buyers had to move quickly.

A balanced real estate market has a six-month supply of inventory available, but the supply in the East Bay fell to 1.2 months in the third quarter and ended the year at barely half a month. November and December typically see a slowdown in sales as the holidays approach, but that wasn’t the case this year. Sales in most neighborhoods in the East Bay remained strong throughout the quarter, and buyer demand helped drive home prices to their highest level since 2007.

The East Bay is a popular destination for buyers priced out of the San Francisco market, but first-time buyers were at a competitive disadvantage when bidding against investors and all-cash buyers.

Looking Forward: Upward pressure on prices should encourage more sellers to put their properties on the market and ease the housing bottleneck. Buyers will be ready, especially with interest rates expected to remain at record lows through much of 2013 and prices still below their peak.

MARIN COUNTY

There was no shortage of buyers in the third quarter, but the sharply limited supply of homes held back sales in the fourth. A balanced real estate market typically has a six-month supply of inventory, but Marin County had only a small fraction of that amount. Every home that came on the market at a fair price sold immediately.

There was no shortage of buyers in the third quarter, but the sharply limited supply of homes held back sales in the fourth. A balanced real estate market typically has a six-month supply of inventory, but Marin County had only a small fraction of that amount. Every home that came on the market at a fair price sold immediately.

Multiple offers were common, helping to inflate prices. The most active price point was for homes selling for $1 million to $2 million. Mill Valley remained especially popular, with sales volume up considerably. Tiburon also saw particularly strong sales. With a sharp rebound in the Bay Area economy, Marin County remained an attractive destination for buyers from San Francisco and for families moving to the Bay Area from out of state.

Looking Forward: Barring monsoon-like weather, or shenanigans in Washington that hurt the economy, all signs point to a healthy first quarter of 2013 and the full year ahead. Our real estate professionals say many sellers are waiting until the end of January to list their homes, which will help ease the frantic pace of bidding on properties. We expect home prices to rise incrementally, but with interest rates hovering near record lows, buying a home will remain a bargain throughout the new year.

NAPA COUNTY

Homes sold briskly throughout the fourth quarter in Napa County, even accounting for the cyclical decline during the holidays. Higher-priced properties at the northern end of the Napa Valley saw particularly strong sales. Farther south, a home selling for under $300,000 in American Canyon received 12 offers, and in the city of Napa most properties priced under $500,000 garnered multiple bids.

Homes sold briskly throughout the fourth quarter in Napa County, even accounting for the cyclical decline during the holidays. Higher-priced properties at the northern end of the Napa Valley saw particularly strong sales. Farther south, a home selling for under $300,000 in American Canyon received 12 offers, and in the city of Napa most properties priced under $500,000 garnered multiple bids.

Buyers who waited to make an offer, hoping to time their purchase at the bottom of the market, missed their opportunity. Some areas saw double-digit gains in prices, and the number of foreclosures and bank-owned properties on the market dropped off significantly while short sales increased. Investors purchased most homes priced below $500,000, making all-cash offers and converting them into rental properties. This made it difficult for first-time buyers to land a home.

Overall, 2012 was a vibrant year. With buyers in abundance, interest rates at an all-time low, and a constrained inventory, many sellers experienced sales-price appreciation that had been absent for several years.

Looking Forward: Our real estate professionals say they expect to see more homes coming on the market starting in mid-January. We project prices to rise 5 to 8 percent in 2013, with no slowdown in offers. Pent-up demand from buyers and low interest rates should make for another busy year.

SAN FRANCISCO

The year 2012 was one of the strongest in recent memory for real estate, and the frenzied pace continued through the fourth quarter, even accounting for a brief lull during the holidays. Pent-up buyer demand and an exceptionally tight supply of properties on the market meant that many homes sold quickly and with multiple offers.

The year 2012 was one of the strongest in recent memory for real estate, and the frenzied pace continued through the fourth quarter, even accounting for a brief lull during the holidays. Pent-up buyer demand and an exceptionally tight supply of properties on the market meant that many homes sold quickly and with multiple offers.

A balanced real estate market typically has a six-month supply of inventory, but the supply of single-family homes and condominiums in San Francisco hovered near record lows in the fourth quarter. Homes sold well across the city, and the condominium market, which had slowed in 2010 and 2011, came roaring back.

San Francisco’s rebounding economy, particularly (but not exclusively) the growth in tech-sector jobs, brought many new buyers into the market, helping drive up home prices by double digits.

Looking Forward: Job growth is a reliable indicator of real estate activity, and that factor alone promises a good year ahead for the San Francisco housing market. Interest rates are expected to remain near record lows through much of 2013, making the outlook even brighter. After a likely cyclical slowdown in January, we expect to see additional homes come on the market and sales take off in February and March.

SONOMA COUNTY

Buyer demand for homes in Sonoma County in the fourth quarter was held back only by a shortage of inventory. Sales dipped in December thanks in part to a cyclical holiday slowdown – but mostly because there weren’t enough homes available. A balanced real estate market typically has a six-month supply of inventory, but we saw only a small fraction of that amount in the fourth quarter.

Buyer demand for homes in Sonoma County in the fourth quarter was held back only by a shortage of inventory. Sales dipped in December thanks in part to a cyclical holiday slowdown – but mostly because there weren’t enough homes available. A balanced real estate market typically has a six-month supply of inventory, but we saw only a small fraction of that amount in the fourth quarter.

The lack of inventory had buyers scrambling, with most fairly priced homes receiving multiple offers that helped push prices higher.

The number of properties selling for $400,000 to $800,000 rose significantly in the quarter, as did homes priced at $1 million and higher. Lower price ranges saw declines in the number of homes selling, in part because of the more limited supply of foreclosures and bank-owned properties in recent months. Additionally, banks have increasingly turned to short sales to clear inventory. Investors, stymied by the tight inventory of single-family homes, stepped up purchases of condominiums.

Looking Forward: Springtime typically brings an increase of homes on the market. With prices gradually rising, a healthier economy than last year, and interest rates still hovering near record lows, we look forward to an active spring and summer.

SONOMA VALLEY

Real estate activity tends to slow toward the end of the year, as both buyers and sellers turn to other pursuits, whether holiday shopping or ski trips to Tahoe. But this year there was no slowdown in the Sonoma Valley, where sales held steady throughout the fourth quarter.

Real estate activity tends to slow toward the end of the year, as both buyers and sellers turn to other pursuits, whether holiday shopping or ski trips to Tahoe. But this year there was no slowdown in the Sonoma Valley, where sales held steady throughout the fourth quarter.

The number of properties for sale dropped significantly in the second half of the year. A balanced real estate market typically has a six-month supply of inventory, but the supply dropped to a small fraction of that amount by the close of the fourth quarter. Buyers were undeterred, however, and bid aggressively for available homes. Even homes considered overpriced or less desirable that had been on the market for some time attracted buyers with few other options – raising the average days on the market for sales overall.

Homes priced fairly generated multiple offers and sold quickly, while average sale prices rose over the course of the year.

Looking Forward: Our real estate professionals expect to see significantly more homes on the market by mid-January and through the spring, which suggests an active year for buyers and sellers. The Bay Area economy has rebounded and consumer confidence is rising – good signs for the housing market. Additionally, interest rates are expected to remain near record lows, making homes more affordable even as prices rise gradually.

TAHOE/TRUCKEE

The Tahoe/Truckee region may seem like a world away from the Bay Area, but its real estate market told a familiar story in the fourth quarter: a dwindling supply of homes for sale and buyers forced into bidding wars for fairly priced properties. Properties still on the market for more than 60 days were often overpriced, less desirable, or problematic.

The Tahoe/Truckee region may seem like a world away from the Bay Area, but its real estate market told a familiar story in the fourth quarter: a dwindling supply of homes for sale and buyers forced into bidding wars for fairly priced properties. Properties still on the market for more than 60 days were often overpriced, less desirable, or problematic.

Many properties in Tahoe/Truckee are second homes for Bay Area residents, and buyers tend to be picky – they’re not interested in homes that require repairs or remodeling. Luxury markets in Truckee’s Martis Camp and the Lake Tahoe basin were hot during the fourth quarter, and Tahoe Donner was the leader in most homes sold for $600,000 or less.

Condominiums sold well during the quarter, as buyers found it easier to get financing for a condo than for fractional-share properties.

Looking Forward: The Tahoe/Truckee real estate market is heavily dependent on events in the Bay Area, and the rebounding economy in San Francisco and surrounding counties suggests an active year ahead. We expect to see an increase in homes coming on the market in the first quarter of 2013, with higher price points than last year. Interest rates are expected to remain near today’s record lows, making homes more affordable even as prices rise.