By now you’ve heard the optimistic news emanating from the media and real estate experts across the country: Housing markets are back on their way up.

Home values are rising, foreclosures are dropping, and housing starts are increasing. In addition, the Federal Reserve’s plan to purchase mortgage-backed securities to the tune of $40 billion a month should contribute to the climb by pushing down mortgage rates and boosting home prices.

Sounds like great news, and it is. But to those of us in the Bay Area, it’s a bit of old news. In January, we predicted we’d see the best year in housing since 2006. So far we have – and there are strong indicators that’ll continue, thanks to sustained job growth, low interest rates, and aggressive buyer demand.

If there’s a downside to all this, it’s that buyers who have been waiting on the sidelines hoping to pounce on a foreclosure or distressed property have likely missed their opportunity. The records being set for number of homes sold in the Bay Area are being accomplished with limited inventory, and this will contribute to price appreciation.

The combination of buyer demand and a continuing constrained supply of available homes is leading to a return of one of the hallmarks of the heyday of Bay Area real estate: the bidding war.

Multiple offers on well-priced properties are becoming the norm in many areas, and for every one buyer who lands the home, there are several frustrated suitors even more determined to find a new abode … thus fueling more multiple offers. We predict housing will be 3 to 6 percent more expensive by this time next year.

Our third-quarter report is packed with regional summaries and data that confirms our optimism. It also includes an exclusive feature story on bidding wars that was posted separately on this site last week.

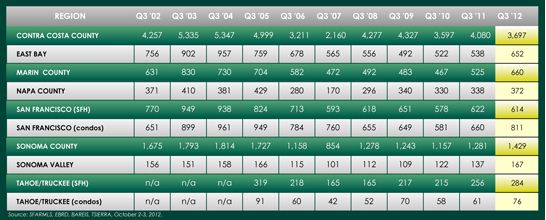

Another feature of the Q3 report is a massive chart that tracks 10 years of home sales throughout the Bay Area and in Tahoe/Truckee — 66 cities, towns and neighborhoods in eight regions. A smaller chart showing regional totals appears below; click on it to see the full data set, which includes selected cities within each region.

Below are some specifics on what’s happening in our regional real estate markets. For full details, please take a look at our complete third-quarter report.

CONTRA COSTA COUNTY

Like other Bay Area real estate markets, buyers in Contra Costa County vastly outnumbered sellers in the third quarter, resulting in multiple bids for fairly priced properties – often just days after homes are first shown to prospective buyers. However, homes priced significantly beyond their appraised value sat on the market longer.

Like other Bay Area real estate markets, buyers in Contra Costa County vastly outnumbered sellers in the third quarter, resulting in multiple bids for fairly priced properties – often just days after homes are first shown to prospective buyers. However, homes priced significantly beyond their appraised value sat on the market longer.

Home sales have been rising all year, and the third quarter was no different. And sales would have been even higher if not for the limited inventory of homes on the market.

Home prices showed an increase in Lamorinda – Lafayette, Moraga, and Orinda – and a small gain in the Alamo, Danville, and Blackhawk communities, where the supply of distressed properties offset the price appreciation on other properties in the area.

Looking Forward: The end of the third quarter saw a small spike in the number of new properties coming onto the market, which may continue into the fourth quarter, but activity will slow down as the year draws to a close – sellers don’t want the distractions of prospective buyers when they’re putting up holiday decorations and spending time with their families. Business is expected to pick up again in January and February and on into the spring.

EAST BAY

Buyers continued to outnumber sellers in the East Bay during the third quarter, and bidding wars among buyers continued apace. Almost 70 percent of all home sales in our East Bay offices involved multiple offers.

Buyers continued to outnumber sellers in the East Bay during the third quarter, and bidding wars among buyers continued apace. Almost 70 percent of all home sales in our East Bay offices involved multiple offers.

Buyers had to move quickly, as many homes in the region sold just a few weeks after coming on the market. The supply of available homes has dropped off significantly during the past year, yet home sales continued to climb higher, particularly in the sub-$1 million market.

Multiple offers on homes helped drive prices higher, and final sale prices in the region averaged 105 percent of the list prices – a healthy bonus for sellers.

Looking Forward: The East Bay remains a popular choice for buyers unable to get a home in San Francisco. Prices are moving higher, which should coax more sellers to put their properties on the market. Home sales are expected to remain strong through the fall, followed by a typical slowdown during the holidays and then picking back up again after the first of the year. If the economy continues to rebound and interest rates remain low, all signs point to a busy spring.

MARIN COUNTY

Homes sold briskly across all price points in the third quarter in Marin County, despite the constrained inventory levels that currently bedevil all real estate markets in the Bay Area.

Homes sold briskly across all price points in the third quarter in Marin County, despite the constrained inventory levels that currently bedevil all real estate markets in the Bay Area.

Open houses were well-attended throughout the quarter, attesting to the pent-up demand among buyers, and Mill Valley remains especially popular. Most sales in the county involved multiple offers.

Home prices are creeping higher but still nowhere near where they were in 2006 and 2007, and it may take several years before those who bought homes at the peak of the market will see significant price appreciation. A big part of the local real estate market typically involves trade-up buyers, but that’s been difficult lately for homeowners unable to sell at the prices they expected.

Looking Forward: Home stagers tell us that they’re busier than they’ve ever been. That’s a welcome sign that the severe shortage of housing inventory may lessen in the very near future, but other indicators suggest that sellers might be waiting until the spring to gauge the increase in home values before they join the market in substantial numbers. Recent action by the Federal Reserve to push down long-term interest rates should further encourage buyers through the next year.

NAPA COUNTY

Our real estate professionals in Napa County had a busy summer, with increasing numbers of interested homebuyers at all price points – especially at the higher end of the market, which remained red-hot throughout the third quarter. In Napa, anything priced under $700,000, if priced well, sold immediately. In St. Helena, anything under $1 million sold equally fast.

Our real estate professionals in Napa County had a busy summer, with increasing numbers of interested homebuyers at all price points – especially at the higher end of the market, which remained red-hot throughout the third quarter. In Napa, anything priced under $700,000, if priced well, sold immediately. In St. Helena, anything under $1 million sold equally fast.

The supply of homes on the market remained tight, with some buyers forced into bidding wars for well-priced properties. Investors remained active, presenting an extra challenge for first-time buyers because investors are often able to submit attractive, all-cash bids. All this activity helped push home prices moderately higher, although they remain below the highs reached in 2006 and 2007.

Wine Country properties remained popular, and a recent trend of Asian investment in the area resulted in at least one winery sold to an Asian buyer.

Looking Forward: October is shaping up to be another busy month, with year-over-year sales growth expected to continue unabated. After the typical slowdown during the holidays, we look for another busy year ahead, helped along by a rebounding economy and historically low interest rates.

SAN FRANCISCO

The summer months typically see a slowdown in home sales, but this summer was anything but slow in San Francisco. An exceptionally tight supply of homes on the market resulted in frenzied activity among buyers looking to get into contracts at all price points in the third quarter, and multiple bids were the norm for all fairly priced properties – both single-family homes and condominiums.

The summer months typically see a slowdown in home sales, but this summer was anything but slow in San Francisco. An exceptionally tight supply of homes on the market resulted in frenzied activity among buyers looking to get into contracts at all price points in the third quarter, and multiple bids were the norm for all fairly priced properties – both single-family homes and condominiums.

Sellers found themselves choosing among multiple offers – in some cases 20 or more – which helped push single-family home prices higher across the city. Prices are now very close to the highs reached at the peak of the market in 2005-2006.

The limited homes-for-sale availability, coupled with strong buyer demand, should contribute to an increase in the median price for single-family homes. We expect this will encourage more sellers to come off the sidelines, which will help inventory levels rise.

Noe Valley, with its family-friendly ambience and the easy commute to the South Bay, was one of the hottest real estate markets in the third quarter. Overall sales volume in the neighborhood was sharply up compared with Q3 in 2011 – a trend that was also seen in the rest of the city’s District 5, which includes Cole Valley, Duboce Triangle, Haight-Ashbury, Mission Valley, and Twin Peaks.

In the condominium market, limited inventory woes continued through Q3, with the months’ supply of inventory tightening up. Even though inventory was down 40 percent, sales were up 38 percent, year over year – a tremendous increase.

As young professionals move into the city with cash in hand from recent tech IPOs and expansions, South Beach will certainly solidify its status as one of the most desirable neighborhoods for condos, especially along the waterfront.

Looking Forward: The constrained inventory that has played havoc with buyers over the past year is finally showing signs of loosening. Our real estate professionals are hearing of a sharp increase in business for stagers, who typically prepare properties for sale, and for professionals who do pre-sale inspections, so expect to see a wider selection of homes for sale over the next six months.

SONOMA COUNTY

The housing recovery in Sonoma County continued at a steady pace in the third quarter, with a marked increase in sales and steady increase in median home prices. Demand was particularly high at the start of the quarter for homes priced below $500,000, with most receiving multiple offers, and we saw increasing levels of demand for virtually all homes priced below $800,000. We saw significant activity among homes priced above $1 million, as well.

The housing recovery in Sonoma County continued at a steady pace in the third quarter, with a marked increase in sales and steady increase in median home prices. Demand was particularly high at the start of the quarter for homes priced below $500,000, with most receiving multiple offers, and we saw increasing levels of demand for virtually all homes priced below $800,000. We saw significant activity among homes priced above $1 million, as well.

The supply of homes remained exceptionally tight. Foreclosures, short sales, and other distressed properties helped keep the housing inventory high in recent years, but there were fewer bank-owned properties coming to market in the third quarter. Meanwhile, some potential sellers were reluctant to put their homes on the market – some because the drop in home values in recent years left them owing more on their mortgage than their home is worth, and others because they don’t have enough equity yet to move up to a higher-priced home.

Looking Forward: With demand pushing prices higher, we expect to see more sellers motivated to put for-sale signs in their front yards in the coming months. Low interest rates, an improving economy, and pent-up demand are expected to keep the housing market busy well into 2013.

SONOMA VALLEY

Like other regions across the Bay Area, the Sonoma Valley communities of Sonoma, Glen Ellen, and Kenwood continued to face a limited supply of properties for sale in the third quarter. As expected, virtually all homes that were priced “right” in the eyes of the buyers, reflecting a true value in terms of location and condition, generated multiple offers. Anecdotally, a vacant land parcel that had been on the market for over a year received multiple offers on the same day and sold for over the asking price. In another situation, a charming “under $500,000 country home” came on the market and after having little or no activity for three weeks, ultimately received four offers in the same three-day period.

Like other regions across the Bay Area, the Sonoma Valley communities of Sonoma, Glen Ellen, and Kenwood continued to face a limited supply of properties for sale in the third quarter. As expected, virtually all homes that were priced “right” in the eyes of the buyers, reflecting a true value in terms of location and condition, generated multiple offers. Anecdotally, a vacant land parcel that had been on the market for over a year received multiple offers on the same day and sold for over the asking price. In another situation, a charming “under $500,000 country home” came on the market and after having little or no activity for three weeks, ultimately received four offers in the same three-day period.

Buyers looking for second homes accounted for an increasing share of the market in the third quarter. First-time buyers faced extra challenges in the region because they often were in competition with investors, who are able to pay more and submit attractive all-cash bids.

Investors have found that they are able to rent their properties in the area at rates that cover their mortgages for the first time in a long time. Here, as in other Bay Area cities, rents appear to be rising at a faster percentage rate than sales prices.

Home prices did rise in the quarter, albeit moderately, although they remain below levels reached in 2006 and 2007. On a positive note, 50 percent more properties with sales prices over $1.5 million sold in the third quarter as compared with the second quarter of this year.

Looking Forward: There is a concern that limited housing inventory for sale will continue throughout the fourth quarter and into the new year, which will promote the occurrence of multiple offers. First-time buyers may still face competition from investors, particularly in the under-$500,000 market, and may find themselves on the losing side of bidding wars more than once.

TAHOE/TRUCKEE

Like the Bay Area, third-quarter real estate activity in the Tahoe/Truckee region was dominated by a limited supply of inventory and resulting bidding wars among buyers. All single-family homes and condominiums that were priced in line with their appraised values got multiple offers, with homes priced from $300,000 to $600,000 especially popular.

Like the Bay Area, third-quarter real estate activity in the Tahoe/Truckee region was dominated by a limited supply of inventory and resulting bidding wars among buyers. All single-family homes and condominiums that were priced in line with their appraised values got multiple offers, with homes priced from $300,000 to $600,000 especially popular.

Many properties in the region are second homes for Bay Area residents, and activity typically spikes whenever prospective buyers are able to spend a few extra days in the area. Accordingly, the week before and after the Fourth of July were extremely busy, followed by a brief slowdown.

September was busy after students returned to school and Bay Area buyers sought to close deals so that they can spend the upcoming holidays skiing in the area. Sales were strong in Tahoe Donner and the Truckee area, with significant lakefront sales as well.

Looking Forward: Unlike traditional residential markets, winter in the mountains can be an active sales time. If skiing conditions are good the winter months have historically seen strong activity and sales, particularly in larger homes suited for skiing families or groups.