In our recent fourth-quarter real estate report, we noted that inventory bottomed out in the majority of our Bay Area markets in the final month of the year. Aspiring buyers who got frozen out as the holidays approached will be glad to learn that more homes appeared on the market as 2014 kicked into gear.

In January inventory expanded in eight of our nine Bay Area regions from the previous month, Sonoma Valley being the lone exception to this trend. At the same time, median prices for single-family homes followed suit, increasing monthly in every region but San Francisco and Sonoma County.

If January is any indication, 2014 is shaping up to be another booming year in the Northern California residential real estate market.

Click on the image accompanying each of our regions below for an expanded look at real estate activity in January.

CONTRA COSTA COUNTY

Both the median sales price and the months’ supply of inventory (MSI) improved modestly in January from the previous month in our Contra Costa County region.

Home prices ended the month at $751,000, a 6 percent gain over December. The MSI rebounded to 1.6 – still strongly in favor of sellers but also a month-over-month increase.

Contra Costa homes stayed on the market an average of 37 days in January, the longest such period in a year. Sellers received 97.7 percent of their asking price, identical to totals recorded in December.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Concord, Danville, Diablo, Lafayette, Martinez, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the adjoining chart includes single-family homes in these communities.

EAST BAY

The MSI in the perpetually sizzling East Bay market shrank to a yearly low in December but more than doubled in January, climbing back to 1.7.

As in Contra Costa County, the median sales price in the East Bay inched back up in January to nearly $724,000, a month-over-month gain of 4 percent. Buyers could afford to spend a little more time shopping than in months past; homes lasted 35 days on the market, also a yearly high.

In another sign that hopeful East Bay buyers are finally getting a bit of relief, sellers received the smallest premiums above asking price in the past 12 months: 0.9 percent. By contrast, East Bay sellers hauled in as much as an average of 13.5 percent above asking price in 2012.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the adjoining chart includes single-family homes in these communities.

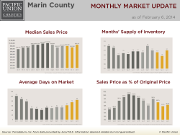

MARIN COUNTY

Marin County home prices jumped back up to nearly $950,000 in January, similar to numbers seen in late summer. At 2.1, the MSI returned to conditions observed at the beginning of the fourth quarter.

Buyers in Marin were patient in the final quarter of 2013, with houses gradually taking longer to sell each month. In January homes left the market in an average of 85 days, the longest stretch in almost a year.

Sellers received 94.5 percent of list price, more than in December but still down from autumn numbers.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the adjoining chart includes single-family homes in these communities.

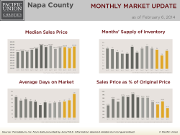

NAPA COUNTY

As in Marin, homebuyers in Napa County started the year patiently, with houses lasting on the market an average of about four months – the longest since last January.

After dipping below the $500,000 mark in December, the median sales price was up 8 percent in January to finish the month at $514,000. Still, buyers seemed to enjoy more negotiating power than in previous months, paying an average of just 90 percent of original price.

The MSI expanded to 3.2, an increase from December but still less than what we saw in the late summer and fall.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the adjoining chart includes all single-family homes in Napa County.

SAN FRANCISCO – SINGLE-FAMILY HOMES

San Francisco was one of just two Pacific Union markets where the median sales price for a single-family home declined month over month in January. Currently at $928,000, the median price in the city has shrunk for the past two months.

January’s slight price drop could be tied to a much-needed inventory hike; in the first month of 2014, the MSI increased to 1.8, double what we recorded in December.

Homes sold in an average of 42 days, identical to the previous month. San Francisco sellers continued to enjoy above-list prices – 3.2 percent in January.

SAN FRANCISCO – CONDOMINIUMS

As Pacific Union noted in a blog post early last month, condominiums in San Francisco are currently in high demand. January’s median condo sales price of $950,000 – the largest in a year and currently higher than single-family home prices in the city — bears out that point.

Still, many new condos hit the market in January, as the MSI increased to 1.9, more than twice what it was the previous month. Buyers took an average of 48 days to purchase a condo in the city, the longest since last April.

San Francisco condos have been selling for more than list price for most of the past year, and that trend persisted in January, when they received 0.5 percent above asking price.

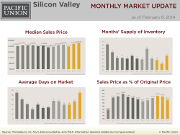

SILICON VALLEY

Home prices in our booming Silicon Valley region continue to pick up steam and reached a yearly peak of $2.4 million in January.

As in San Francisco and the East Bay, the MSI in Silicon Valley essentially doubled from the previous month, climbing back to 2.1. Sellers received ever so slightly more than asking price, but that premium decreased from the final quarter of 2013.

Silicon Valley buyers were also biding their time, with houses taking an average of 55 days to sell. That’s the longest we’ve seen since last January, when we also recorded a days-on-market time of 55.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding Alpine Road area and east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the adjoining chart includes all single-family homes in these communities.

SONOMA COUNTY

The median sales price in Sonoma County declined a barely perceptible $4,000 from December, starting 2014 at $461,000. The current median sales price is still up a vigorous 26 percent from January 2013.

Buyers in the region benefited from a slight inventory bump in January, when the MSI increased to 2.1. Perhaps because of this, buyers also had a bit more negotiating power than in December, with homes selling for about 6 percent less than original price.

Homes stayed on the market 80 days, almost exactly the same as in the final two months of last year.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the adjoining chart includes all single-family homes and farms and ranches in Sonoma County.

SONOMA VALLEY

Home prices in our Sonoma Valley region rocketed up 27.5 percent month over month in January. The current median price of $608,500 is the highest recorded in the region over the past year.

Inventory decline may have had a hand in those soaring prices. Indeed, Sonoma Valley was Pacific Union’s only region to see its MSI constrict in January; the 1.8 recorded is a yearly low.

Homes sold in an average of 80 days in January, and buyers paid 92 percent of original price.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the adjoining chart refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

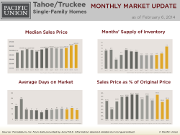

TAHOE/TRUCKEE – SINGLE-FAMILY HOMES

Along with Silicon Valley and Sonoma Valley, prices for single-family homes in Pacific Union’s Tahoe/Truckee region enjoyed yearly highs in January, coming in at $637,500. Single-family home prices are now up a robust 39 percent year over year.

Like median prices, the MSI was also at a yearly high of 7.8. Inventory in Tahoe/Truckee was at its lowest in the summer, as buyers swooped in on homes in advance of the ski season.

Homes stayed on the market 87 days, about 40 days shorter than last January. Sellers received 92 percent of list price, a modest improvement over December.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes single-family homes in these communities.

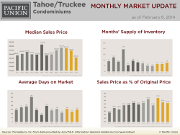

TAHOE/TRUCKEE – CONDOMINIUMS

While single-family home prices in Tahoe/Truckee were on the upswing, condo prices went the opposite way, slipping 32 percent from December to reach a 12-month low of $262,000.

In other respects, condominium trends in the region mirrored those seen for single-family homes: The MSI was 7.9, and sellers took in 92.5 percent of original price.

Condos in Tahoe sat on the market for about five months in January, exactly four weeks longer than in December.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes condominiums in these communities.