The median sales price reached one-year highs in four of Pacific Union’s Bay Area regions in the first quarter, most notably in Silicon Valley, where it neared the $3 million mark. And in our East Bay region, home prices topped $900,000 in the final month of the quarter, while buyers shelled out an average of 16 percent above original price to close a sale.

Pacific Union’s first-quarter 2015 report is packed with data and regional summaries that offer a complete look at real estate activity in the Bay Area and the Lake Tahoe/Truckee region.

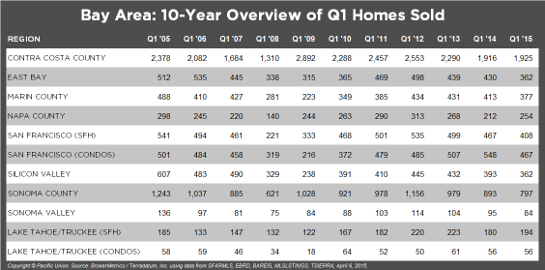

Our Q1 Report also includes a comprehensive chart tracking 10 years of home sales throughout the Bay Area and Lake Tahoe/Truckee — 76 cities, towns, and neighborhoods in nine regions. A smaller version of that chart, showing regional totals, appears below. Click anywhere on the chart to see the full data set.

CONTRA COSTA COUNTY

The first quarter of 2015 started slow in Pacific Union’s Contra Costa County region, but real estate activity picked up significantly during March, including a steady increase in the number of homes on the market. Nonetheless, buyers continued to outnumber available properties, meaning that many homes received multiple offers. In some neighborhoods, sales prices topped asking prices by 10 percent or more.

Homes sold more quickly than in recent quarters, so buyers needed to have their financing in order and act fast in order to close a deal. The average sales price continued to rise throughout the quarter, and sometimes appraisals became a problem, as lending institutions failed to keep pace with current market prices.

Looking Forward: We expect to see more inventory hit the market in the coming months, as sellers realize that 2015 may mark a high point for prices. The region’s attractive homes and excellent schools continue to draw buyers – aided in no small way by low interest rates and a booming Bay Area economy. The market remains difficult for first-time buyers, but otherwise all signs point to a healthy and busy spring and summer.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Danville, Diablo, Lafayette, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the report charts includes single-family homes in these communities.

EAST BAY

The first quarter of 2015 started slowly in Pacific Union’s East Bay region but picked up speed as the quarter progressed and an exceptionally tight supply of homes gradually eased. Meanwhile, there was no shortage of buyers in the region, and the market seemed more competitive than ever. Nearly 90 percent of homes garnered multiple offers by the end of March, and anxious buyers offered far above asking prices to secure a property. In some neighborhoods, sales prices were 40 percent above asking prices.

The inventory of available homes has been constrained in the East Bay for several years now, yet it dropped even further in the first quarter from one year ago, with the number of new listings unable to keep pace with buyer demand. The most popular neighborhoods for buyers were those that score high on walkability ratings and are close to BART stations.

Looking Forward: We expect to see a strong supply of homes coming on the market in the second quarter, and reports that home stagers have been busy in the final weeks of March seem to confirm that optimism. There should be no shortage of buyers in the East Bay in the coming months.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the report charts includes single-family homes in these communities.

MARIN COUNTY

Inventory expanded solidly in Pacific Union’s Marin County region during the first quarter of 2015, but the extra supply of homes sold quickly – a testament to the pent-up buyer demand throughout the region. Home prices continued to increase throughout the quarter, and virtually all properties that were priced fairly and in desirable neighborhoods received multiple offers. It was not uncommon to see buyers offer all cash and waive contingencies to close a deal quickly.

Mill Valley was a particularly hot market, but sales were strong in all price ranges across the region – particularly for high-end properties. The quarter also saw a significant number of private purchase agreements, reached without homes ever appearing on a local MLS and without competing bids. Such off-market deals can simplify the sales process, but they don’t guarantee the highest possible prices.

Looking Forward: Spring is typically a busy season for real estate, and with a robust regional economy and interest rates still hovering near record lows, the coming months should see exceptional levels of activity in Marin County. Sellers seem to realize that now is an optimal time to put their homes on the market, and buyers will be waiting.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the report charts includes single-family homes in these communities.

NAPA COUNTY

After a quiet January and February, real estate activity roared back to life in March, with Napa County buyers getting a jump on spring. Sellers also joined the party, making for a more robust supply of available homes in the first quarter than we’ve seen in quite a while.

Buyers didn’t shy away from bidding aggressively for correctly priced homes in desirable areas, but they seemed to play it safer than in past quarters – not moving as quickly to sign a sales contract, for example. And while sellers were more plentiful than in the past few years, they were also cautious; roughly one-third of all home sales in the region were contingent on sellers finding a new home for themselves.

Looking Forward: Many Napa County sellers wait until flowers bloom and their properties look their best before putting them on the market, virtually guaranteeing a brisk spring and summer. We expect the third quarter will also see exceptionally strong demand for high-end properties such as wineries and vineyard land after several years of relatively weak sales.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the report charts includes all single-family homes in Napa County.

SAN FRANCISCO

Inventory shortages continued to bedevil San Francisco‘s real estate market during the first quarter of 2015. Homes were in short supply at all price points, particularly condominiums, and it wasn’t uncommon to see attractive, fairly priced properties go under contract barely a week after arriving on the market. Sales prices climbed steadily throughout the quarter, and most homes received multiple offers from what seemed to be an inexhaustible supply of would-be buyers.

Sellers, meanwhile, faced a dilemma: Putting their homes on the market, even with the promise of a high sales price, instantly placed them in the same position as other buyers – scrambling to find their next home. The solution for many sellers in San Francisco was to negotiate a rent-back agreement with the buyer, giving them some extra time to search for a new property.

Looking Forward: The second quarter typically sees strong activity, but there are additional factors that should help supercharge real estate sales this year: a booming local economy and interest rates still hovering near record lows. All signs point to a busy spring and summer for the San Francisco real estate market.

SILICON VALLEY

January was exceptionally quiet In Pacific Union’s Silicon Valley region, and February was only slightly better. Thank goodness for a busy March, when the inventory of available homes rose solidly and buyers came out of hibernation. Sales in the first quarter were strongest in the region’s most affluent communities. The most active price point was for homes priced from $2 million to $3 million, followed by those priced from $3 million to $5 million, then those priced above $5 million.

One trend of note regarding Silicon Valley real estate is the increasing number of private purchase agreements between buyers and sellers, without the home listed on the MLS or any competing bids. Such agreements accounted for 21 percent of Silicon Valley sales in the second quarter of 2014, and they have been rising ever since, accounting for 35 percent of sales in the first quarter of 2015. While an off-market transaction can simplify the sales process for sellers, it doesn’t always translate to the highest possible price.

Looking Forward: Springtime is in full swing, and Silicon Valley’s charming communities, top-rated schools, and ample parks will continue to woo homebuyers. We expect sales prices to continue rising and the inventory of homes to pick up substantially as the year progresses.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the report charts includes all single-family homes in these communities.

Defining the Mid-Peninsula: Our real estate markets in the Mid-Peninsula subregion include the cities of Burlingame (excluding Ingold Millsdale Industrial Center), Hillsborough, and San Mateo (excluding the North Shoreview/Dore Cavanaugh area). Sales data in the report charts includes all single-family homes in these communities.

SONOMA COUNTY

“Where did all the sellers go?” might have been the most frequently asked question in Pacific Union’s Sonoma County region in the first weeks of 2015. The supply of homes was exceptionally tight, frustrating the best efforts of buyers hoping to make an off-season deal. Thankfully, inventory loosened by mid-February and expanded even more by March. Buyer demand, meanwhile, remained exceptionally high. Contracts were drawn up and homes were put into escrow as quickly as they came on the market.

Sales prices, meanwhile, continued to climb throughout the quarter, reflecting not only the rising value of the properties but also the nature of homes on the market. One year earlier, foreclosures and short sales accounted for much of the region’s sales activity, but virtually all of that stock was exhausted by the start of 2015, and the market moved up to higher-priced homes.

Looking Forward: We expect a bustling spring selling season. Sonoma County’s supply constraints will continue in the second quarter, but those sellers who put their homes on the market with a fair price will likely see multiple offers and a quick sale.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the report charts includes all single-family homes and farms and ranches in Sonoma County.

SONOMA VALLEY

The first quarter of 2015 followed a typical pattern in Pacific Union’s Sonoma Valley region: a very slow January and February, as sellers waited for springtime flowers to bloom and show off their homes in the best light, followed by a busy March. In fact, more homes hit the market in March than in January and February combined. Attractive homes that were properly priced received multiple offers, but buyers didn’t rush into deals with the same urgency we saw a year earlier. Homes stayed on the market longer than they had in the recent past, and some sold only after price reductions.

Homes priced below $600,000 tended to sell quickly. Those priced between $1 million and $2 million also found plenty of buyers, but the market for homes priced between $2 million and $3 million was slow. Several over-55 communities also saw increased activity and substantial price increases in the quarter.

Looking Forward: From all indications, the spring selling season in Sonoma Valley will be unbelievably busy – the strongest since at least 2006. Sellers will find plenty of buyer interest, while buyers wil discover that they have more leeway in transactions than they have had in several years.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the report charts refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

LAKE TAHOE/TRUCKEE

Homebuyers typically fall in love with the Lake Tahoe/Truckee region after spending a few days at the region’s world-class winter resorts. But when a dearth of snow keeps skiers away, real estate activity slows down. That, in a nutshell, explains the first quarter of 2015. But there was also an upside to having little or no snow on the ground: Buyers didn’t have to wait until spring to fully inspect properties, and many sellers were flexible in pricing and eager to make a deal.

Homes that were priced fairly and in sought-after neighborhoods saw the most activity during the quarter, and the strongest sales were for those priced less than $1 million. The inventory of available homes and condominiums remained strong, giving buyers a wide selection to choose from.

Looking Forward: Droughts are cyclical in California, and snow will return to the Sierra Nevadas. In the meantime, the spring and summer months in the Lake Tahoe/Truckee region offer Bay Area residents unrivaled outdoor activities. Buyers looking for vacation homes will find an ample supply, along with receptive sellers. Altogether, we expect a busy spring and summer season. Looking ahead, recently announced plans to build a gondola line connecting the Squaw Valley and Alpine Meadows resorts will be welcomed by residents and winter visitors alike.

Defining Lake Tahoe/Truckee: Our real estate markets in the Lake Tahoe/Truckee region include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the report charts includes single-family homes and condominiums in these communities.