This year’s busy spring season is shaping up to be even better than last for Northern California home sellers, with median prices up from May 2013 in each of Pacific Union’s nine regions.

Indeed, home prices hit yearly highs in a number of our regions in May, including Contra Costa County, the East Bay, Marin County, Napa County, and San Francisco. In three of those counties, median single-family home prices remained above $1 million, and while prices in Silicon Valley tapered off a hair from March, they are still close to $2.5 million.

Meanwhile, inventory constricted from the previous month in all of our markets but San Francisco, and homes in the Bay Area’s hottest pockets are still commanding premiums, as buyers ignite bidding wars for the most desirable properties.

Click on the image accompanying each of our regions below for an expanded look at real estate activity in May.

CONTRA COSTA COUNTY

For the third straight month, the median price in our Contra Costa County region topped the $1 million mark and was up 13 percent year over year. Buyers paid an average of 2 percent above asking prices, which like the median price represented a yearly high.

The months’ supply of inventory (MSI) in Contra Costa County has been dropping for the past three months and landed at 1.5 in May. Buyers took an average of 18 days to close deals, tying a yearly low.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Danville, Diablo, Lafayette, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the adjoining chart includes single-family homes in these communities.

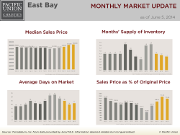

EAST BAY

The median price in our East Bay region hit $826,000 in May, the second month prices have climbed above $800,000. Though sellers landed smaller premiums than in April, they still pulled in about 12 percent above list, on average.

At 1.1, the East Bay’s MSI is the lowest in any of Pacific Union’s regions and has been declining steadily since February. Homes left the market in an average of 22 days, a few days longer than in May 2013.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the adjoining chart includes single-family homes in these communities.

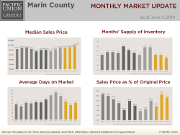

MARIN COUNTY

At $1.1 million dollars, the median sales price in Marin County is up a healthy 16 percent year over year.

After two months of holding steady, the MSI once again dropped in May to finish the month at 1.4. Buyers took an average of 52 days to close transactions, a week longer than in April.

Sellers received an average of 99 percent of list price, nearly identical to levels observed the preceding May.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the adjoining chart includes single-family homes in these communities.

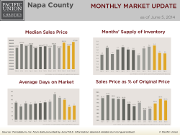

NAPA COUNTY

Hopeful Napa County buyers who have been waiting around for the market to cool will be disappointed to learn that the median sales price hit a yearly high in May: $575,000. Home prices in the county have increased 21 percent on an annual basis.

Even with rising prices, Napa County homes are still fetching less than asking price, with sellers getting about 95 percent of list. Homes sold in an average of 71 days, about a month faster than they did earlier in the year.

The Napa County MSI was 3.1, a slight decrease from April and similar to what we observed a year ago.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the adjoining chart includes all single-family homes in Napa County.

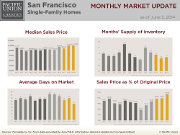

SAN FRANCISCO – SINGLE-FAMILY HOMES

The median single-family home price on the San Francisco side of the Golden Gate Bridge was identical to its neighbor to the north in May: $1.1 million. Last May, prices topped $1 million in the city before slowing in the summer and fall.

San Francisco sellers are currently getting the highest premium over asking price in the Bay Area, at more than 13 percent. And buyers were eager to move quickly; homes took an average of 26 days to sell, the shortest amount of time in the past year.

San Francisco was the only Pacific Union market to see the MSI grow from the previous month, and it currently stands at 1.3.

SAN FRANCISCO – CONDOMINIUMS

After flirting with the $1 million milestone in March, condo prices in San Francisco came even closer in May, closing the month at $995,000.

Continuing a pattern we’ve seen for the past year, competition for properties drove buyers to pay above list price, this time by almost 8 percent. As with single-family homes in the city, condos were selling faster than they had at any point during the past 12 months, an average of 29 days.

San Francisco’s condo stock also expanded from April, with the MSI rising to 1.4 – still strongly skewed toward sellers.

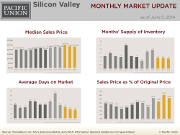

SILICON VALLEY

May property prices in our Silicon Valley region were lower than in March or April, but buyers in this booming area still had to shell out more than a median price of $2.4 million to get their hands on a single-family home.

The region’s MSI dipped to 1.4, its lowest level since last December. Buyers took an average of 19 days to seal a deal, one day faster than in April and the lowest totals recorded in the past 12 months.

Sellers received about 5 percent above asking price, a slight decrease from the preceding month.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding Alpine Road area and east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the adjoining chart includes all single-family homes in these communities.

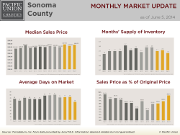

SONOMA COUNTY

After declining from March to April, the median sales price in our Sonoma County region headed back up toward the half-million dollar mark, to finish May at $486,000. Sellers took home nearly 99 percent of asking prices, the most since May 2013.

Sonoma County’s MSI fell below 2.0 for only the second time in the past year. Homes left the market in an average of 58 days, by far the quickest we’ve seen in quite some time.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the adjoining chart includes all single-family homes and farms and ranches in Sonoma County.

SONOMA VALLEY

Home prices in our Sonoma Valley region tend to fluctuate more on a monthly basis than in other Bay Area markets, and May found median prices on the downswing at $559,500. Even so, sellers banked almost 100 percent of original price, the highest levels observed in the past year.

At 2.2, the Sonoma Valley MSI was the smallest it had been since June 2013. Buyers took an average of 47 days to purchase a home in the region, much faster than in any other month so far this year.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the adjoining chart refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

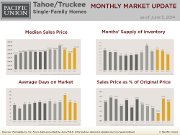

TAHOE/TRUCKEE – SINGLE-FAMILY HOMES

The median price for a single-family home in Pacific Union’s Tahoe/Truckee region has been higher than $600,000 for all but one month of 2014, and in May it rebounded to $638,000. Home prices in the region are up 33 percent on an annual basis.

Buyers paid about 94 percent of list price, slightly less than in April, while the MSI declined to 5.3, the lowest levels recorded in six months. Homes stayed on the market for 97 days, down a bit from the preceding month.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes single-family homes in these communities.

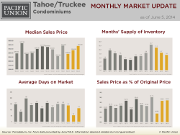

TAHOE/TRUCKEE – CONDOMINIUMS

At $387,500, the median Tahoe/Truckee condo price was 31 percent higher than it was last May. The 7.6 MSI was a drop from the previous month, but the Tahoe/Truckee region still decidedly remains a buyer’s market.

Sellers took home about 95 percent of asking price, nearly identical to the preceding month. Condos in the area sat on the market for an average of 114 days, the longest for any type of property in all of Pacific Union’s regions.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes condominiums in these communities.