As the typically brisk spring homebuying season burst into full bloom, buyers in most of Pacific Union’s regions moved faster to close purchases than they did the previous month. The average days a single-family home lasted on the market decreased in every one of our regions, month over month, except for San Francisco, with houses selling particularly quickly in Contra Costa County, the East Bay, and Silicon Valley.

Only Sonoma County saw the months’ supply of inventory (MSI) increase from March to April, and even then the housing-stock gain was barely perceptible to buyers. The median sales price for a single-family home reached yearly highs in several of our hottest regions, including the East Bay, Marin County, San Francisco, and Sonoma Valley.

Click on the image accompanying each of our regions below for an expanded look at real estate activity in April.

CONTRA COSTA COUNTY

For the second straight month, median prices topped the $1 million benchmark in our Contra Costa County region, though they cooled slightly from March. Home prices in the region are now up nearly 16 percent year over year.

At 1.5, the MSI was exactly the same as it was one year ago. Buyers grabbed available homes in an average of 18 days, a one-year low and less than half the time they took in January.

Sellers received asking-price premiums of nearly 2 percent, nearly identical to totals recorded in April 2013.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Danville, Diablo, Lafayette, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the adjoining chart includes single-family homes in these communities.

EAST BAY

Median home prices in our East Bay region passed a milestone in April, climbing above $800,000 for the first time in recent memory to land at $824,000.

Inventory in the East Bay has been constrained for quite some time, and the 1.2 MSI was down a hair from March and identical to last April. Buyers took just 19 days to snap up properties, significantly quicker than in the first month of the year.

East Bay buyers have become accustomed to dealing with multiple offers and overbids, but in April, they were paying the highest premiums seen in a year: almost 14 percent.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the adjoining chart includes single-family homes in these communities.

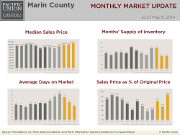

MARIN COUNTY

For the third time in the past 12 months, the median sales price in our Marin County region surpassed $1 million. As in many of our regions, scant inventory is at least partially responsible for high prices; at 1.6, the MSI was unchanged from March but still at a yearly low.

Homes took an average of 45 days to sell, similar to what we saw the previous spring. And for the first time in nearly a year, sellers received more than their asking price – an average premium of 0.8 percent, to be exact.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the adjoining chart includes single-family homes in these communities.

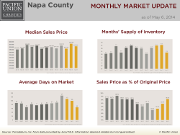

NAPA COUNTY

Buyers in Napa County who didn’t act in March, when inventory reached a yearly high, might be feeling pangs of regret now. In April, the MSI sunk to 2.9, the lowest it has been so far in 2014. The median price also shrank month over month to $515,000, though it is still up 13 percent from the previous April.

Buyers took an average of 66 days to close transactions, the fastest levels recorded in more than a year. Since 2014 began, sellers have pulled in an increasingly higher percentage of asking prices each month, reaching 96.5 percent in April.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the adjoining chart includes all single-family homes in Napa County.

SAN FRANCISCO – SINGLE-FAMILY HOMES

Single-family homes in San Francisco commanded more than $1.1 million in April to achieve a yearly median price peak. Inventory, meanwhile, has been contracting every month since 2014 began. The MSI –1.2 in April – has been lower only once in the past year, when it bottomed out in December 2013.

As in the East Bay, buyers in San Francisco faced stiff competition, with the average single-family home netting almost 10 percent above asking price. Sellers in the city have been raking in healthy premiums for most of the past year.

Homes stayed on the market an average of 35 days, exactly as long as they did in April 2013.

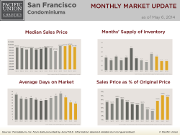

SAN FRANCISCO – CONDOMINIUMS

After ascending to yearly highs in March, median condominium prices in San Francisco cooled a bit in April to $917,000.

As in many of our regions, the lack of inventory surely frustrated hopeful owners. The MSI for condominiums in the city was down to 1.1, unchanged from March but still almost at a one-year low.

San Francisco condos sold in an average of 29 days, with sellers netting 7.5 percent premiums.

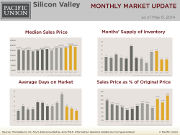

SILICON VALLEY

Although the median sales price was down a bit month over month in our Silicon Valley region, successful buyers were still dropping almost $2.5 million for a home in one of the country’s most scorching real estate markets.

Homes left the market in 20 days, tied for a one-year low. At 1.5, the MSI was unchanged from the previous month but down significantly from earlier in the year.

Like in other hot pockets of the Bay Area, buyers had to throw down more than asking price to get deals done, an average of about 6 percent.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding Alpine Road area and east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the adjoining chart includes all single-family homes in these communities.

SONOMA COUNTY

Sonoma County was one of the few Bay Area regions where buyers took a bit more time on average to close purchases than in the preceding month: 74 days. At 2.1, the MSI is similar to levels recorded for most of the past year.

The median sales price dropped from March to land at $469,000 in April. Buyers paid about 97 percent of list price, the highest since the end of last year.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the adjoining chart includes all single-family homes and farms and ranches in Sonoma County.

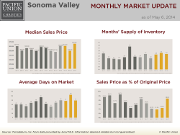

SONOMA VALLEY

At nearly $660,000, the median sales price reached a yearly peak in our Sonoma Valley region. Price appreciation was robust from March to April, with gains of about 32 percent.

Home in the region sat on the market for more than 100 days in March, but in April that number fell to 79. The current MSI of 3.0 is nearly the same as it was at the same time last year.

Sellers got an average of 97 percent of list price, the most since last November.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the adjoining chart refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

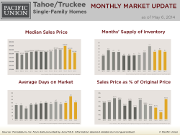

TAHOE/TRUCKEE – SINGLE-FAMILY HOMES

After rising above $600,000 for the past four months, the median price for a single-family home in our Tahoe/Truckee region dropped to $530,000 in April.

At 6.2, the MSI in the area is well above what it was one year ago. On average, homes sold more than a month quicker than they did in March, with buyers paying about 95 percent of original price.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes single-family homes in these communities.

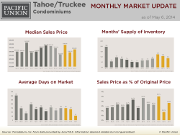

TAHOE/TRUCKEE – CONDOMINIUMS

The median sales price for a condominium in the Tahoe/Truckee area recovered by almost 14 percent from March to April to land at $329,500. Buyers moved faster than usual to close transactions; the average 56 days on market was almost three times shorter than it was earlier in 2014.

Condo inventory in the region has been shrinking for the past couple of months, with the MSI falling to 8.9 in April. Sellers received an average of 93 percent of asking price, not drastically different from what we’ve observed for the past year.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes condominiums in these communities.