Median home prices in many of our Bay Area regions took a small dip in July. And while prices in some markets continued to slide ever so slightly in August, they were on the upswing in others.

Napa County saw median home prices hit a 12-month high of $530,000, a year-over-year hike of 40 percent. Single-family homes in the Tahoe/Truckee region also experienced yearly price peaks at nearly $550,000. Meanwhile, prices in Marin and Sonoma counties, which reached yearly highs in July, cooled off a bit.

Inventory was still in short supply in almost every region, but the problem was most pronounced in Contra Costa County, the East Bay, and San Francisco. Those three markets also saw a continuing trend of buyers paying above list prices, with the East Bay leading the pack.

CONTRA COSTA COUNTY

After a minor decrease in July, August median sales prices were back up in Contra Costa County to $815,000, the second-highest they’ve been in the past 12 months.

Inventory held steady at a 1.3-months’ supply, identical to what it has been since April. Buyers continued to shell out more than original price, but only by 0.2 percent. Homes stayed on the market for exactly three weeks, the same amount of time we recorded in July

EAST BAY

East Bay median sales prices were also on the rise from July to August and reached $750,000, a 1 percent month-over-month bump. Inventory reached its lowest levels of 2013 in August, with just a 1.0-month’s supply.

Properties in the East Bay are still commanding the highest sales-to-original-price ratio in Pacific Union’s Bay Area markets, an average of 7.5 percent above. Meanwhile, homes lasted on the market for a bit longer than they have for the past six months: 23 days, on average.

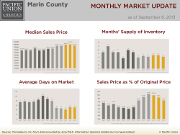

MARIN COUNTY

After cracking the million-dollar mark last month, median sales prices in Marin County were back near where they were in the spring, closing out August at $957,500. The sales-to-list-price ratio dropped slightly for the second straight month, to 96.8 percent.

The months’ supply of inventory (MSI) in the county tightened a hair from the past two months and moved back to 1.7, identical to levels in May. Homes took 51 days on average to leave the market, one day shorter than in July.

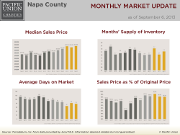

NAPA COUNTY

For the third consecutive month, home prices in Napa County were north of the $500,000 mark. August’s $530,000 median price was the highest we’ve seen in the past 12 months but is up just 5 percent from July.

Inventory rebounded a bit from the previous month and was back to a 3.2-months’ supply. Napa County homes stayed on the market for an average of 78 days in August, the second-shortest time period over the past year.

Buyers paid 96.2 percent of the original price, almost exactly the same as they did in July

SAN FRANCISCO, SINGLE-FAMILY HOMES

After dipping into the high-$800,000 range last month, prices for single-family homes in San Francisco were back near $1 million — $985,000, to be exact. And buyers continued to pay above-list prices by about 5 percent, the same as in July.

The MSI held steady at 1.3 for the third consecutive month. Meanwhile, homes took an average of 37 days to sell, the longest period we’ve seen since the spring.

SAN FRANCISCO, CONDOMINIUMS

Unlike their single-family-home counterparts, San Francisco condominium prices fell in August to $826,000, a month-over-month slip of 6 percent. Since February, buyers have received higher-than-list prices, and that trend continued in August, when they enjoyed 4.9 percent premiums.

San Francisco had a 1.1-month’s supply of condominium inventory, a tiny increase from July but still the second-lowest levels in the past 12 months. Condos left the market in an average of 35 days, the quickest pace in the past year.

SONOMA COUNTY

As was the case in Marin, Sonoma County home prices saw an August drop after attaining yearly peaks in July. The median sales price in the county fell to $440,000, an 9 percent month-over-month slide. That said, prices in Sonoma County have been above $400,000 since March.

Homes lasted and average of 68 days on the market, three days shorter than in July. The MSI in Sonoma County shrunk slightly to 1.8 but is still in the same neighborhood as it has been since the spring.

Sellers received 97.5 percent of their homes’ original prices, consistent with what we saw in June and July.

Median prices in Sonoma Valley fell 6 percent from July, finishing August at $496,000. It was the first time that prices in the region dipped below $500,000 since March.

Inventory improved in August to a 2.2-months’ supply, and homes took longer to sell than they did in July by more than a week — up to 76 days. Buyers paid 95.1 percent of original prices, 3 percent less than they did last month.

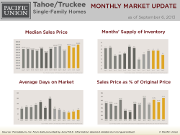

TAHOE/TRUCKEE SINGLE-FAMILY HOMES

Single-family home prices in our Tahoe/Truckee region enjoyed yearly highs of nearly $550,000, a month-over-month jump of 11 percent. Sellers received 93 percent of their original price after netting 95 percent in the previous three months.

The MSI for single-family homes in the area began to shrink in August, down to 4.4 from 5.7 in June and July. Meanwhile, homes stayed on the market for 88 days, the longest period since April.

TAHOE/TRUCKEE CONDOMINIUMS

Median sales prices for condominiums in the Tahoe/Truckee region also rebounded in August to $350,000, a gain of 17 percent from July but still 9 percent shy of their 12-month highs.

Tahoe continued to have a healthy amount of condos on the market, with a 7.5-months’ supply. Properties sold in 147 days, 25 percent quicker than they did in July.

Buyers paid 95.4 percent of original prices, not wildly different from the previous two months.