Why haven’t companies like Zillow, Trulia, and Redfin killed off real estate brokers?

Businessweek recently published an article that asked the question but didn’t offer up a definitive answer. But we don’t think it’s a mystery: There are perfectly logical and compelling reasons that explain why the disintermediation of real estate professionals hasn’t happened.

We’ve discussed this before in explaining why real estate professionals aren’t dinosaurs. But for now, let’s take a look at where this article missed the mark.

Value and Visceral Reactions

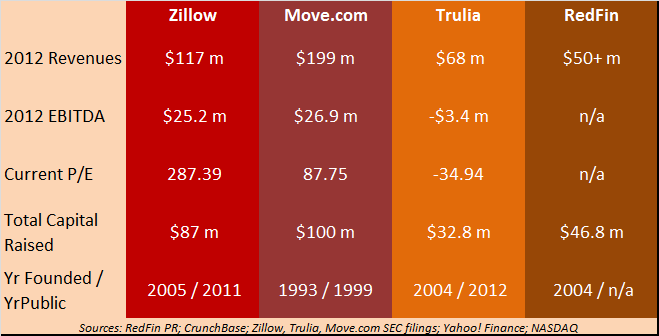

The author, Brad Stone, starts off by noting that Internet real estate aggregators Zillow, Trulia, and Realtor.com (owned by Move.com) and online brokerage Redfin are attracting plenty of visitors and, for some, generating plenty of revenue (see chart, right).

The author, Brad Stone, starts off by noting that Internet real estate aggregators Zillow, Trulia, and Realtor.com (owned by Move.com) and online brokerage Redfin are attracting plenty of visitors and, for some, generating plenty of revenue (see chart, right).

“It all looks at first glance like the same kind of electronic marketplace that has eliminated travel agents, decimated classified ads, depressed stock brokers, and taken the swagger out of car dealers,” he writes.

But that assumption misses a couple of key factors.

First, the electronic marketplace eliminates the bricks-and-mortar marketplace only if it benefits the consumer. On the whole, consumers are smart. They’re motivated. They’re shrewd about bargains. And if they can do something on their own quickly, easily, and effectively while saving money, you can be sure they’ll do it.

That’s why Expedia.com has supplanted travel agents, online banking and ATMs have reduced banks’ physical footprints, and Amazon.com has become a behemoth in the book industry. Consumers saw the benefits and jumped aboard in droves.

If it hasn’t happened with the real estate industry despite all the efforts of Redfin and its ilk, it’s not a marketing failure: It’s a value proposition failure.

Second, electronic beats real only if the end product is homogeneous. A book is a book is a book. To a slightly lesser extent, you can say the same about a hotel room, a plane flight, or a stock transaction. But almost every house is different. Not just structurally, but for the “it just feels right” qualities that make a house the right home for one person or another, and for the context of place that surrounds it.

Buying or not buying a home can come down to a purely visceral reaction: how it smells, if you like the view, if the small rooms make you feel cozy or suffocated.

Seriously: Have you ever “felt” something about a plane ticket?

Consumers Aren’t Stupid

Stone’s article, like many others addressing this question, seems to suggest that consumers would stop using real estate professionals if they just thought about it for a minute.

Please. In an age when almost limitless real estate information is at our fingertips, suggesting that consumers are somehow oblivious to the realities of a real estate transaction is foolish.

Stone’s article takes this tack when he cites studies that show, presumably, just how untrustworthy our industry can be – including one that alleges “collusion” and one that suggests people who sell their homes by themselves get better prices. The unspoken conclusion is that if, despite these obvious problems, people still use real estate professionals … well, consumers must be stupid!

But a closer looks suggests these studies may not tell the whole story – or are significantly behind the times.

For example, in a 2008 study, economists Steven D. Levitt (yes, the guy behind “Freakonomics”) and Chad Syverson discuss the collusion argument:

“If a buyer’s agent offers clients low-cost access to online home listings, for example, other agents can refuse to make their own listings available through such channels. Or, if a seller’s agent cuts her commission rate, other agents may be able to steer their potential buyers away from her listings.”

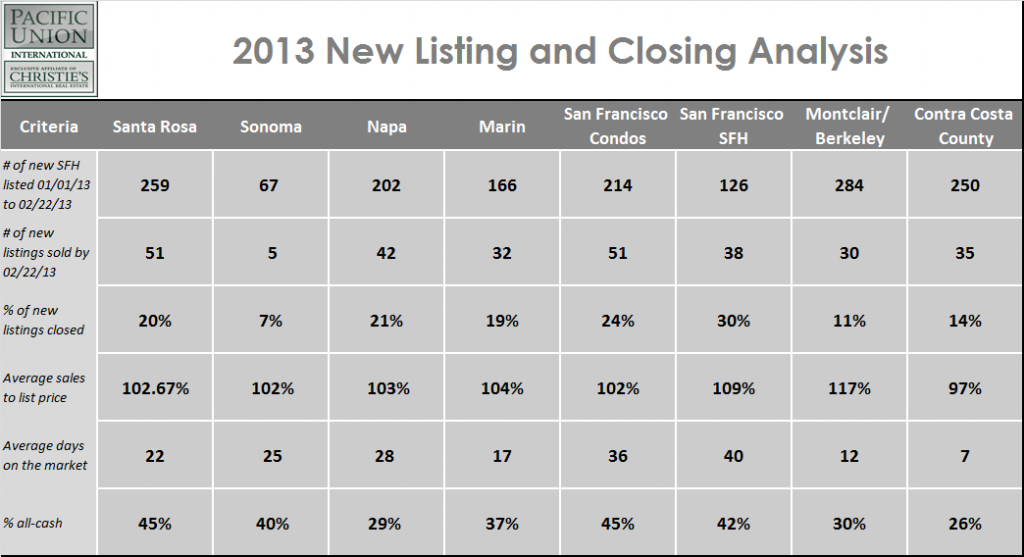

Today, here in the Bay Area, the supply of available homes is so limited that bidding wars have returned, the number of days from listing to sale are plummeting, all-cash offers are rising, and most homes are selling over asking price. The trend has been growing since the middle of last year and shows no signs of lessening — the chart below illustrates the Bay Area real estate market velocity in just the first seven weeks of 2013.

In this hypercompetitive market, do you honestly think any real estate professional would steer a client AWAY from a home for sale? Or refuse to make her clients’ listings available to a buyer represented by a company like Redfin?

Besides, in addition to being unethical and strategically unsound, it would be just about impossible for any real estate professional to “hide” listings from a client. In 2011, 88 percent of home buyers used the Internet as a source of information in their home searches. Good luck trying to keep a client from stumbling on a home you want to hide!

And then there’s the for-sale-by-owner (FSBO) study cited, which found that an owner’s use of a real estate professional to sell a property reduced the eventual selling price by 5.9 percent to 7.7 percent, compared with homes sold by the owner directly.

Now for the fine print:

The homes in that study were all university housing on the Stanford campus. Ownership of the homes was limited to Stanford faculty and some senior staff. And none of the listings were on the MLS. So we can’t consider this a credible study of true market dynamics by any measure.

Let’s take a look at the real world instead. According to the National Association of Realtors, homes for sale by owner netted an average sales price of $150,000 in 2012. For home sales assisted by a real estate professional, the price spiked to $215,000. That’s a whopping 43 percent difference.

We’re betting that most consumers are savvy enough to use the Internet and to understand the real FSBO numbers. So, sorry, we don’t buy the argument that hapless consumers are just being misled and misinformed and THAT is why they aren’t flocking to Internet brokers.

Dollars and Good Sense

Finally, the inevitable “why are consumers still paying those fees?” argument comes up. Stone discusses the rise of Internet research, notes that real estate fees have remained relatively stable over time even though consumers seem to be doing more of the legwork, and adds, “Economists have long been perplexed by the resilience of the real estate agent.”

Well, it’s really not that hard to understand from our perspective.

The Internet has made things easier in some respects (access to information) but far more complicated in others (how to parse the flood of data that’s out there). Real estate professionals, with their unique knowledge of local markets, years of experience, and insightful recommendations, thus become paradoxically even more important: They are the guide through the jungle of all that data.

The digital world also means their costs to successfully market their clients’ properties have risen. They don’t just need postcards these days – they need dedicated websites for each property, video tours, high-end digital photography, QR codes for their signs … and the list goes on. There’s a plethora of new digital marketing opportunities that the real estate professional needs to seize (and pay for).

In part that’s why fees have remained stable. And it’s also worth noting that all real estate commissions are, of course, negotiable. But there’s a bigger reason why consumers are still willing to pay the fees. It’s simply this: expertise.

If the article claimed to be “perplexed by the resilience of specialized orthopedic surgeons” or the continued demand for skilled woodworkers or top-notch computer technicians, we’d laugh. After all, there’s a reason why certain professions remain steady or in-demand. It’s that people are willing to pay a highly trained expert — not a general practitioner, not a handyman, not their cousin’s friend Bill — for a better outcome.

And when it comes to buying or selling a home, which is one of the most significant transactions of their lives, most consumers don’t want to sacrifice expert representation just to get a discount.

And when it comes to buying or selling a home, which is one of the most significant transactions of their lives, most consumers don’t want to sacrifice expert representation just to get a discount.

Yes, Redfin, the discount online brokerage, does appeal to some, especially with its great search technology. But people seemingly don’t find much value in the advice and services of Redfin’s real estate professionals. After nearly nine years and millions in venture capital money, Redfin remains a niche player.

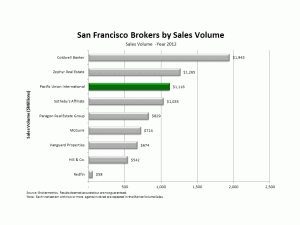

Here in the Bay Area, perhaps the most “wired” market in the country, Redfin’s market share is negligible. For example, in San Francisco, sales volume leader Coldwell Banker posted $1.9 billion in 2012 sales. Pacific Union, in third place, had $1.1 billion. By contrast, Redfin netted just $58 million.

Here in the Bay Area, perhaps the most “wired” market in the country, Redfin’s market share is negligible. For example, in San Francisco, sales volume leader Coldwell Banker posted $1.9 billion in 2012 sales. Pacific Union, in third place, had $1.1 billion. By contrast, Redfin netted just $58 million.

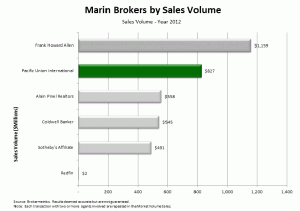

Similarly, in Marin, Frank Howard Allen led the pack with $1.16 billion in 2012 sales; Pacific Union was second with $827 million. And Redfin? It barely made the charts at $2 million.

Summing Up

So, why haven’t the Zillows and Redfins of the world killed off real estate brokers? Because they can’t replace what makes our professionals essential to the transaction: the market mastery, the in-the-trenches experience, the advice and recommendations that take decades to develop. They can’t match the combination of deep knowledge, insight, and instinct that allow our people to identify a client’s dream home — and ultimately make that client’s dreams a reality.

The Internet is great for research. But search algorithms, virtual tours, and robots just can’t replace professional expertise.

It’s really that simple.