Work From Home — Day 10

Flashback to Feelings of Our Last Crisis

5:07AM PST

Team –

5:07 AM

Good morning – Futures are up 111 points. Could today be a consecutive day of positive results?

As I reflect on our recent challenges I continue to be reminded of the great recession. In concert with my reflections, I received calls yesterday from Patrick Barber, President former PUI and Brent Thomson, COO, former PUI.

Patrick’s statement on our call was “Mark, I think you thrive on these times over normal times.” Brent’s comment was “we have seen worse and we will outperform any and all expectations the industry holds. This is what we do for our people!”

For perspective, I dug deep last night with Terry Whistler and surfaced an old video he produced following the great recession. We filmed this video on an amazing autumn weekend. I vividly remember Jessica Grimes’, VP Marketing, daughters running around, but very well behaved.

Watch only the first 1 minute and 15 seconds of this perspective — the rest is not relevant anymore.

This is not only where we are, but who we are in our new normal

The Compass platforms and programs take these reflections to an entire new level of extraordinary.

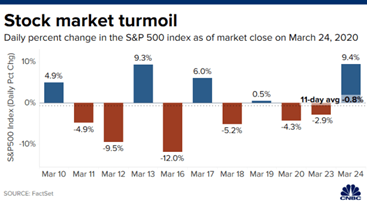

This chart is an illustration of our new normal. A 12-day positive moving average, but a very volatile path to get there. Today we may see approval of a $2 trillion stimulus bill. As perspective, this represents 10% of our 2019 $21.7 trillion GDP.

Great Update about Fannie, Freddie and Ginne today.

Thursday’s update will be all about good-to-great!

How can I help you in your personal situation? Call me! Thanks!

Mark

Mark A McLaughlin

Work From Home — Day 10 —Closing Bell

Deep End of The Pool

5:50PM PST

Team –

It’s amazing that today I enjoyed a sense of calm at my desk — that’s a relative statement, and a function of the number of frantic calls/emails I received. Busy day for sure — just the calmest in 10 days.

2020 Olympics postponed; equity markets stable for a day. CA unemployment claims in first two weeks of March hit 1 million — never before seen! These are largely hospitality, restaurant and bar business related – but we are not done yet!

Relief packages, if gov’t can finalize, seem to reach deep into each impacted individual and family making under $150,000 per year. Further relief coming for small businesses (think your LLC) that will also be helpful. In total, relief packages are estimated at $2 Trillion or 10% of 2019 USA GDP. It will take 3-4 weeks, once approved, to deploy the stimulus; however, it may well prop-up the portion of the economy that’s suffering the most.

I reconnected with C.A.R. today and they are setting up hotlines to help anyone eligible. Do your research before you call the hotline.

All that, and I felt a sense of calm today in the deep end of the pool?

This expression, “deep end of the pool,” was first shared with our Leadership Team by an industry consultant working with PUI on multiple projects in ’13. This consultant was somewhat astonished by our pace and appetite for risk, service and growth while pushing the envelope in business.

We all looked at each other and said, “we live in the deep of the pool.” Come on in! Now we are all in it for sure.

I have received many calls and emails asking, what does the path forward look like? And, when will it begin?

Working with Gary Kurotori, CFO, former PUI, we are modeling our 180-day outlook based on the current SIP as well as assumptions we can make after the flattening of the coronavirus infection curve. We don’t control SIP, or its release, but Gary’s team is exceptional at modeling our business given a specific set of guidelines.

Macro conditions we are using in our models:

- Both supply and demand are currently constrained by SIP.

- We are very fortunate that our inventory [homes for sale or supply] is not perishable, but evergreen. Unlike an airline seat, which is perishable, our inventory is a fixed asset. What is not sold this month can be sold next month.

- Interest rates are at record lows.

- We will see softening in pricing around 10%.

- 15% due to a combination of increased supply and lower demand from employment trends.

We will model all this for NorCal & SoCal and publish Monday or Tuesday.

Calm waters today in the deep end of the pool. Give a virtual hug to everyone you love and make sure they know it!

Thanks!

Mark

Mark A McLaughlin