Here’s a look at recent news of interest to homebuyers, home sellers, and the home-curious:

PRICE MARKDOWNS BECOMING RARE

We’ve been reporting for months now that the tight supply of homes on the market is helping drive prices higher. The flip side of that coin is a reduction in homes with price markdowns.

In Oakland the number of homes on the market priced below their original asking price dropped to 15 percent in early January from 31 percent a year ago, according to Trulia Inc.

Oakland had the smallest percentage of markdowns in the United States. Nationally, the rate was 33.6 percent, down from 36.7 percent a year ago.

COMPLAINT WEBSITE PROMPTS WARNING

The California Association of Realtors warned last week that “a website of suspicious origin” is misusing the Realtor trademark “in what seems to be an attempt to get money from real estate practitioners.”

The site, Realtor-complaints.com, claims to publish consumer complaints about real estate agents, but it offers those agents an “opportunity” to pay as much as $199 to have the complaint and their name removed from the site.

The site claims to have been in business since 2002, but the C.A.R. said an investigation by the National Association of Realtors found that the site was initially registered on Internet domain-name servers on Jan. 1.

HOME CONSTRUCTION REBOUNDS

Homebuilders ended the year on a high note, with the U.S. Census Bureau reporting that construction starts on new homes rose 37 percent in December from a year earlier.

The increase in housing starts was even higher in Western states, swelling 57 percent year over year.

Nationwide, an estimated 780,000 housing units were started in 2012, up 28 percent from 2011. Western states saw 174,700 housing starts, a 32 percent increase.

MORTGAGE RULE UNDER SCRUTINY

A federal rule that sets new benchmarks for “qualified mortgages” could hurt borrowers who resorted to jumbo mortgages — loans too large to qualify for government backing.

Jumbo mortgages exceed Fannie Mae and Freddie Mac loan-guarantee limits and remain common in the Bay Area’s high-priced housing markets. Federal guarantees top out at $625,000 in San Francisco, Alameda, Contra Costa, and Marin counties, and at $592,250 in Napa County and $520,950 in Sonoma County.

Earlier this month, the Consumer Financial Protection Bureau announced the new loan benchmarks, which have faced scrutiny ever since. Two recent articles online that help shed light on the issue are a column by veteran real estate journalist Ken Harney on the Inman News website and an analysis on The Wall Street Journal’s Developments blog.

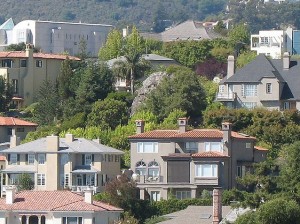

(Oakland photo courtesy of Rbotman01, via Flickr.)