In a few days, Pacific Union will release first-quarter results for our Bay Area and Tahoe/Truckee real estate markets. Home sales and prices rose solidly in the quarter despite an exceptionally tight supply of available properties, setting the stage for a very busy year ahead.

In a few days, Pacific Union will release first-quarter results for our Bay Area and Tahoe/Truckee real estate markets. Home sales and prices rose solidly in the quarter despite an exceptionally tight supply of available properties, setting the stage for a very busy year ahead.

But first we want to give you an early look at a feature story included in the Q1 report — a report on how today’s aggressive market conditions are helping underwater homeowners regain equity and giving them added incentives to put their properties on the market.

It has been a bitterly cold few years for would-be sellers in the Bay Area, but spring is bringing welcome warmth for both home values and buyer activity.

Home prices have been rising for a year across all of Pacific Union’s eight regions in the Bay Area and Tahoe/Truckee. In San Francisco the median sales price of homes rose nearly 30 percent in the first quarter from a year earlier, and all other regions saw double-digit increases as well.

In a recent Wall Street Journal survey, economists agreed that home prices will continue rising at least through 2017, and the Bay Area’s strong economy suggests price increases here will outpace those in most of the rest of the nation.

Those rising values translate to greater equity, and many homeowners who believe they are “underwater” – owing more on their mortgages than their homes are worth – may be surprised to learn that they’ve regained equity based on recent sales prices for comparable homes in their neighborhood.

Why the lift? In part it’s because a persistent shortage of homes for sale has created a veritable army of aggressive and highly motivated buyers who are willing to outspend the competition. For example, in our East Bay offices, 90 percent of transactions in the first quarter involved multiple offers; on average, homes sold for 13 percent over asking price.

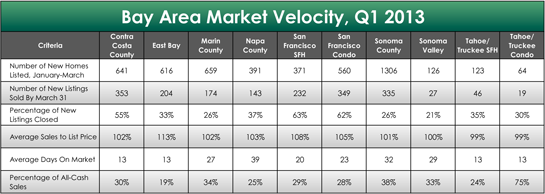

Homes in the Bay Area sold within weeks of coming on the market, frequently in all-cash deals, and multiple bids pushed sales prices above asking prices in all regions, much to the delight of sellers.

Overall, the increased velocity of real estate activity in the first quarter of 2013 was nothing short of remarkable.

This means that sellers looking to trade up to a higher-priced home may now make significant gains in the current market. For example, consider a homeowner whose property was valued at $300,000 in 2006 but dropped 20 percent in value to $240,000, for a loss of $60,000. That same 20 percent drop in value for a higher-priced home – say, a $450,000 home now worth $360,000 – gives a trade-up buyer savings of $90,000, or a net gain of $30,000 on the new home.

Today’s low mortgage rates also offer serious savings to trade-up buyers. In 2002, when the interest rate on a 30-year fixed-rate mortgage stood at 6.5 percent, the monthly payment on a $500,000 loan was $3,160. At current rates, which hover around 3.6 percent, approximately the same loan payment would buy a home with a $700,000 mortgage – a net gain of $200,000.

The benefit won’t last forever, so prospective sellers should move quickly: A report from the Mortgage Bankers Association predicts that rates will average 4.4 percent by the end of 2013. That 0.8 point rise will add $230 to the monthly payment on a $500,000 mortgage.

So if you’re thinking about selling in this blazing market, don’t get burned by waiting too long. And count on the expertise of a real estate professional who knows the local market to help assess your home’s current value and prospects.

Looks like it’s shaping up to be a hot season for sellers!

(Illustration courtesy of Lumaxart, via Flickr.)