Research firm CoreLogic issued the first full analysis of the 2012 housing market Monday, and it confirms the good news we’ve been reporting for months now: Homes sales and prices are rising, new-home construction is back on track, and foreclosures are down dramatically.

Even better news: “The housing market enters 2013 poised for further recovery, with improvements in prices, sales and serious delinquencies,” Core Logic wrote in its latest MarketPulse report.

“This is an extremely positive development for the economy because the real estate cycle drives the business cycle … that drives economic growth.”

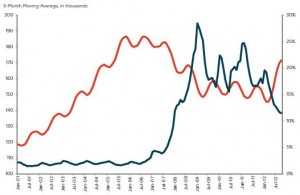

Home sales rose 6 percent in 2012 to 4.2 million, the first increase since 2005. Equity sales – excluding foreclosures, bank-owned properties, and short sales – jumped 11 percent to 3.2 million, while new-home sales increased 3 percent to nearly 300,000.

Home prices, meanwhile, rose 6.3 percent, year over year, for the largest increase in six years.

CoreLogic said home prices “are by far the most important indicator in the housing market because they have strong ripple and housing-wealth effects.”

The research firm credited the price rise to a “massive reduction” in bank-owned homes for sale and the historically low inventory of homes on the market.

Bank-owned homes are a drag on overall home prices because they typically sell at a discount of 20 to 30 percent.

CoreLogic said sales of bank-owned homes are down 60 percent from their peak in April 2009, indicating that the housing industry is “transitioning to a more stable, long-term recovery.”

The drop in foreclosures also signals an improving economy. At the end of November 2012, there were 2.6 million mortgages in serious delinquency – 90 days or more past due – down 15 percent from a year earlier and down 28 percent from their peak in January 2010, according to the report.

Looking forward, CoreLogic said it “expects continued market improvement, with home prices expected to rise 6 percent in 2013 due to high affordability fueling steady demand, a lower level of REO (bank-owned) sales and a low inventory of unsold homes.”

Rising home prices, it said, “will slowly release the pent-up supply of inventory as under-equitied (underwater) borrowers are unlocked and opportunistic sellers begin to provide relief to tight inventories.”

(Chart courtesy of CoreLogic.)