Work From Home — Day 49

Never Bet Against America

5:15AM PST

Team –

The first 45 days of SIP were mentally and emotionally demanding on me; Friday, May 1, 2020 was somewhat transformative. Friday represented two breakthrough events. We completed the second re-forecasting of our business, and it was day one of our ability to safely and cautiously show properties.

From all my listening posts this weekend, the relaxed showing guidelines have brought tenacious buyers out of the woodwork. Is this demand a function of our previously constrained buyers and sellers? Is the demand from new buyers and sellers who realize after SIP they live in a home they do not particularly enjoy? Time will tell.

This renewed activity and the closings in the next 20 days will define our markets for the spring and summer months. Please remind your sellers, it’s always better to set the comparable sales vs. react to them. Move on bids now and set the comparable sales vs. listing in June or July when the delayed spring inventory may join the market.

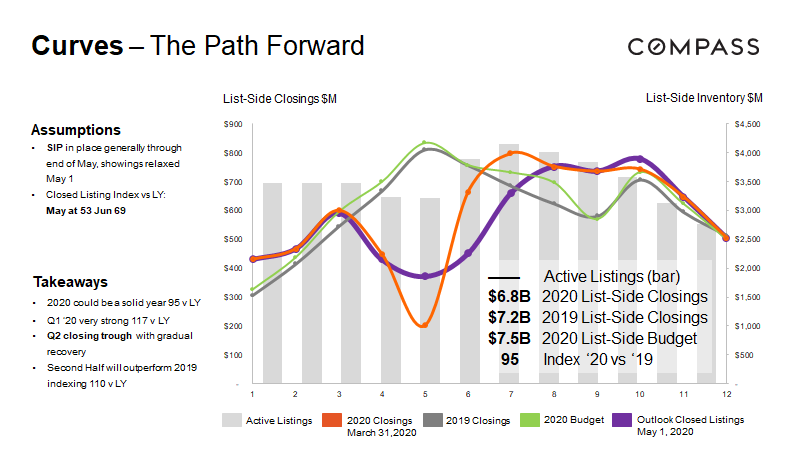

As a foreshadowing of our new business outlook, our forecast for May closings is up 100 percent from our previous forecast. More details this afternoon via the Closing Bell — Pending, New Escrows, and Closing Report. This business confidence lifted my spirits in a meaningful way. Friday late afternoon, I was out on San Francisco Bay and enjoyed some relaxing time — away from it all!

On Saturday, I listened to the 2020 Berkshire Hathaway Annual Meeting. It’s long, it does not move fast, but neither do most investors that are 89 years old. Warren Buffett was simple in his schooling and advice. He shared his perspective dating back to his birth. Of course, his perspective has always been long-term.

He must have said five times “Never Bet Against America.” The fortitude of America has a stellar track record. He advised against using debt or margin to invest in equities and to look at equity investments as long-term partnerships, not daily trades.

He likes the S&P as an indicator of future earnings (he does not invest in indexes), and is certain equities will outperform the 10-year treasury. Fascinating perspective in the middle of this crisis. He will continue to invest over 10 to 20-year horizons. Amazing for a legend 89 years old.

Residential real estate in California went into SIP healthy and strong. I expect our financial sector to lead the path forward.

Details via the Closing Bell including our updated Curve chart for year-end 2020.

This is Where WeAre Now.

Thanks!

Mark

Mark A McLaughlin

Work From Home — Day 49 — Closing Bell

Pending, New Escrows and Closings

3:10PM PST

Team –

As I mentioned this morning, our May business has responded very favorably to the relaxed showing orders (county-by-county). PUI’s current May forecast (purple line) is nearly twice the original May forecast (red line) from March 31, 2020.

While the current June and July outlook is lighter than expected March 31, it’s reported by our regional managers that the cause is preparing properties for market and not a lack of supply coming to market.

Also, very encouraging is the way Chartwell Escrow’s business is bouncing back. Chartwell’s e-closing process could not be timelier. The significant reduction in cancellations are reflective of these very durable SIP escrows!

What we will be watching week-to-week is the pace in which we see new inventory come to market. The gray bars in the background are our current inventory (measured by the right axis). We need to see that number drive to $4 billion from the current level of $3.3 billion.

Also remember The Path Forward Curves (attached) only track listings as they are our earliest indicator of our activity. We close roughly 50 percent listing and 50 percent buy-side trades every month so the curves should maintain the same shape. Obviously, the steeper the purple curve gets the better off our businesses perform.

Reflect on these curves internally. Your personal business can outperform these by growing your market share.

This is Where We Are Now.

Thanks!

Mark

Mark A McLaughlin