Work From Home — Day 8

People, GDP & The Mortgage Business

5:10AM PST

Team –

I joined the residential brokerage business in 2006. At social events (back when we used to have them), I always answered the question “what do you do?” with a simple response, “I run a real estate brokerage company.” That said, I am not in the real estate business, I am in the people business. You are all in the real estate business. I have always subscribed to a simple statement: If we don’t get the people right, nothing else matters. Our leadership team is keeping our focus on you!

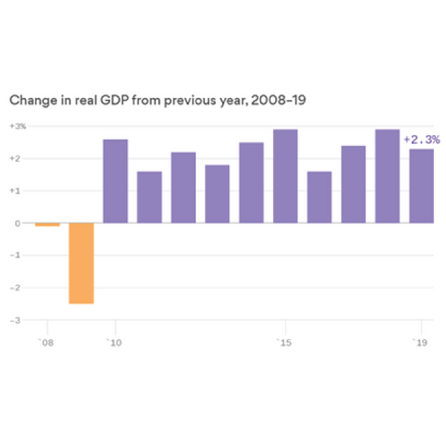

This too shall pass. I did some research today on GDP since the great recession, from 2008 – 2009. While 2009 itself was very rough, the steady, year-over-year change in GDP averaged over 2%.

2019 USA GDP was $21.7 trillion. The Fed seems to be considering between $2 – $4 trillion in economic stimulus – this is between 10% and 20% of total USA GDP. This is massive and will make a difference in our economic recovery.

Yesterday, I interviewed the CEO of one of USA’s largest independent mortgage banks. His 2019 loan volume was $4.8 billion across 80 offices in the USA. Here are the highlights, again I’ll be brief. We have three basic channels of mortgage products in the USA:

- Federally guaranteed mortgages like Fannie, Freddie & Ginnie

- Large depository banks like Wells, Chase, BofA and First Republic

- Non-banks who “make a market” and then securitize / sell loans to the secondary mortgage market.

Feds are expected to announce today new guidance on virtual appraisals. In addition, Feds will buy ALL production that comes their way via Fannie, Freddie and Ginnie Mae.

Large banks are very healthy and will likely continue lend conforming and jumbo products at exceptional, but not rock bottom rates.

The non-banks, if not already, will very, very soon be completely withdrawn from lending as their investors have no bid to buy the loans.

What this means to you in the field, is like in 2009 – 2012, the pre-qualification/approval letter should be either for a “conforming loan” or from a large depository bank who has capacity as a portfolio lender (keeping it on their balance sheet).

The refinance business will likely rage for the next 60 – 90 days!

Whether representing a buyer or seller – dig deep on details of the loan approval letter.

This will be another wild week. Volatility in the equity markets will be normal. It’s very important to stay connected with family, friends and your co-workers.

On Saturday afternoon, my parents, sisters, children and nieces / nephews shared a Google Hangouts. I am a believer! We laughed, shared grocery store experiences, and generally hung up in a happier mood. It was a great way to socialize while sheltering in place.

Finally, remember to meet people where they are, which means really listening hard.

Mark A. McLaughlin