Work From Home – Day 1

Open House Traffic – International Buyers

4:54AM PST

Good morning on day one of Work From Home [WFM]. I believe we are about to be challenged. The DOW Index Futures are down today 10%. Wild ride comes to mind. 1,000-point swings are not unusual.

Together we are a force and we will inspire each other, exchange information and be amazing advisors to our clients. I went through this as a principal during 9-11 and again acquiring PUI in 2009.

Learn from reality – we will thrive!

Several calls I had on Friday included WFM people on the other end. It was wonderful to hear all the kids’ voices in the background. We will all need to be sensitive to our colleagues and clients with their kids or family at home.

Family first has always been one of our core values. Time to walk the talk!

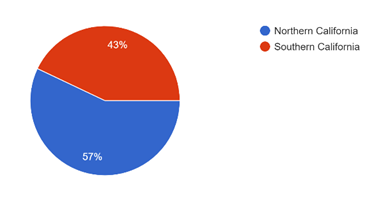

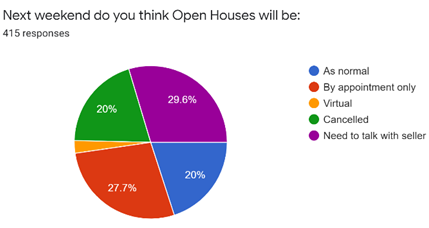

Yesterday we circulated a survey to measure Open House activity in CA. We split the survey SoCal vs NorCal, by price point etc. Click here for Survey Results which are both compelling and cautious.

High level summary as of 4:54 AM from more than 450 responses are:

- 38% of respondents had an open house. 12% were cancelled.

- 81% of Open Houses were priced under $3 million

- 64% had between 6 and 50 groups thru the Open House.

- 50% Expected more than one offer.

- Split 50/50 on next week’s Open Houses by Appointment or Normal vs 50% cancelled or need to talk with Seller

In a recent Korn Ferry posting, it was said that one of the most important attributes of leadership (at work, with your clients and your family) is meeting people “where they are.”

Where “they are” is not a physical place, it’s an emotional, mental and practical space. It’s not a location, it’s our state of mind.

Be the best for your team and clients – meet them in their current state-of-mind and you will be remembered for a lifetime.

Listen first!

Use facts only when clients can hear them.

Yesterday I exchanged e-mails with Gary Beasley, CEO & Co-Founder, Roofstock. The Coronavirus seems to be driving excessive demand to USA from foreign investors.

Roofstock, a California-based fintech company, lists single-family rental homes for sale on its website, most with tenants already in place. It also offers management services, so the investor never has to visit the property.

In recent weeks, Roofstock noted traffic from investors in Asia on its site jump 500%, 450% jump from investors in Germany, a 250% surge from Australia and a 100% increase from the UK. The story is here on CNBC.

We hope this international buyer interest helps support our market activity.

We are embarking on a journey together like never we have seen. Our collective experiences provide wisdom and vision that have served us well in the past and will power us through the coming challenges.

I am working from home the next few weeks like many of you! My mobile number is below, and I encourage you to use it and call me. Nothing is more important than you, your family and your clients.

To US, our TEAMMATES and OUR CLIENTS!

Together we are better!

Thanks!

Mark

Mark A. McLaughlin

Work From Home – Day 1 – Closing Bell

Update on Compass Concierge & Bridge Loan

6:45PM PST

Team –

Changes are happening at a ferocious pace. I hope all of you are remaining safe and staying positive through this challenging time. I wanted to update you on changes Compass is proactively making to our Concierge and Bridge Loan Services.

For Concierge, we are going to be temporarily restricting the approval framework to projects that do not exceed $30,000 for homes that do not exceed $3 million in list price (other requirements remain the same). Concierge Capital will also be limited to the funds delivered only through the debit card. These revised policies maintain our focus to the sweet spot of our market and should mitigate disruptions.

In addition, Concierge is withdrawing from second home markets including Napa & Sonoma Counties and the City of Malibu. We partner with leading financial institutions and lending partners to drive the Concierge program and based on what they are seeing in the overall market, they have strongly recommended making these temporary adjustments.

For Bridge Loans, we are temporarily pausing the Bridge Loan Advance offering of the greater Bridge Loan Services program. Bridge Loans are still active, and we are fully supporting it through our partners as a great means to better serve your clients during these times of high anxiety. This will not affect Bridge Loan Advance loans already applied for or approved.

Across the industry, we are seeing competitors discontinue services similar to Concierge altogether as uncertainty in the market rises. We are committed to continuing to invest in these programs, so you have these tools at your disposal as you advise clients through the coming weeks.

We will be closely monitoring the fluidity of this situation and will continue to share updates as we learn more over the coming weeks.

If you have any questions, please do not hesitate to reach out directly to our Concierge team (CompassConcierge@compass.com) or our Bridge Loan team (BridgeLoans@compass.com).

As always, if you have questions, please feel free to call me.

Thanks!

Mark

Mark A. McLaughlin