Pacific Union’s newly released fourth-quarter 2014 report is packed with sales data and regional summaries that offer a complete look at real estate activity in the Bay Area and the Lake Tahoe/Truckee region.

For this report, we have teamed with noted consulting firm John Burns Real Estate Consulting to deliver nine housing and economic outlooks that offer a lens into the future of Bay Area real estate through 2017.

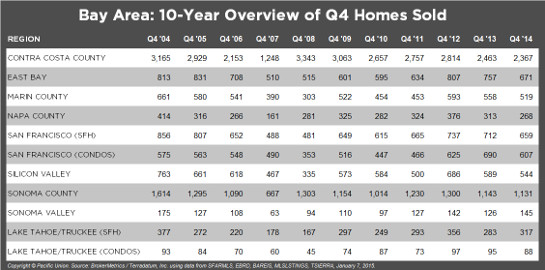

Our Q4 Report also includes a comprehensive chart tracking 10 years of home sales throughout the Bay Area and the Lake Tahoe/Truckee region — 76 cities, towns, and neighborhoods in nine regions. A smaller version of that chart, showing regional totals, appears below. Click anywhere on the chart to see the full data set.

CONTRA COSTA COUNTY

Real estate activity slowed in the fourth quarter in Pacific Union’s Contra Costa County region, held back by a shrinking pool of available homes. It’s a problem that has bedeviled the region for much of the past year, caused in part by would-be sellers who remain unsure of the market and where they will find their next homes. At the same time, buyers were more cautious in the fourth quarter, too. Except in the most sought-after communities such as Lafayette and Orinda, few buyers were willing to pay above the list price or engage in bidding wars.

Home prices were up solidly compared with one year ago, although the pace of appreciation slowed significantly from what we saw one and two years ago — more evidence that the Bay Area’s real estate markets are gradually settling down after several years of frenzied recovery. Fewer high-end properties sold during the fourth quarter than in previous quarters, though that will likely change as spring approaches.

Looking Forward: We expect to see more homes coming on the market in the first and second quarters of 2015, spurred not just by the advent of springtime but also the likelihood that the current near-record-low mortgage rates will soon disappear.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Danville, Diablo, Lafayette, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the report charts includes single-family homes in these communities.

EAST BAY

Fourth-quarter home sales typically start to slow as the holiday season approaches, but another factor was also at work during the last quarter of 2014: an extreme shortage of available homes in Pacific Union’s East Bay region. The number of new listings fell precipitously after the first week of November and didn’t recover. But if sellers were in short supply, buyers were not, and those properties that were available were quickly sold.

The East Bay remains a popular destination for buyers priced out of San Francisco, and the most in-demand neighborhoods were those that score high on walkability ratings and are close to BART stations. Homes selling for $500,000 to $1 million saw the most sales activity, and those that were priced accurately attracted multiple offers and sold above their list prices.

Looking Forward: With an exceptionally robust local economy and mortgage rates still hovering near record lows, we expect strong sales in 2015. Many sellers wait until springtime before putting their homes on the market, but we recommend that they start earlier — in January and February, when less competition will help their properties stand out. Talk with a real estate professional now if you plan to prepare your home for sale in the coming weeks.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the report charts includes single-family homes in these communities.

MARIN COUNTY

A tight supply of available homes held back fourth-quarter sales in Pacific Union’s Marin County region. Buyers were plentiful, however, resulting in rising sales prices overall and multiple offers on all well-priced homes in attractive areas. Homes priced from $1 million to $2 million saw the biggest increase in sales. Continuing a recent trend, the quarter also saw a significant number of private, off-market sales.

Like other Bay Area regions, homeowners in Marin County were slow to put their properties on the market even as sales prices continued to rise —perhaps worried about their prospects after the transaction when they, too, would become buyers in a tight market. Buyers, meanwhile, were more selective than in past quarters, refusing to settle for anything less than exactly what they wanted.

Looking Forward: We are optimistic that 2015 will be a strong year for Marin County home sales. The Bay Area’s vibrant economy will continue to encourage buyers, aided by near-record-low mortgage rates. And with no shortage of qualified buyers, would-be sellers should consider putting their homes on the market sooner rather than later. The supply of available homes will expand by the springtime, and properties on the market before then will enjoy less competition.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the report charts includes single-family homes in these communities.

NAPA COUNTY

Pacific Union’s Napa County region enjoyed robust sales throughout the fourth quarter. The supply of homes was tight — a common problem throughout the Bay Area — but buyers were eager to scoop up any fairly priced property and in all areas of the county, from the city of Napa in the south to high-end communities such as St. Helena farther north.

Napa County is no longer the tight seller’s market of a year ago. Properties sat on the market longer in the fourth quarter, and buyers were able to negotiate deals that were unheard of in the first and second quarters. That said, attractive properties that were priced well still commanded multiple offers throughout the county.

Looking Forward: We expect to see increased inventory levels beginning in January and continuing through the spring and summer. Many sellers wait until flowers are blooming and their properties are looking their best before they put their homes on the market, but we encourage them to get a jump on the competition and put out a for-sale sign early in the year. Rents are high and mortgage rates are low, and many prospective homebuyers may find that they can pay less in monthly mortgage payments than they would in rent.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the report charts includes all single-family homes in Napa County.

SAN FRANCISCO

Real estate activity typically pulls back in San Francisco during the fourth quarter as buyers and sellers alike turn their attention to holiday planning, and such was the case as 2014 wound down. The seasonal slowdown helped keep the inventory of available homes exceptionally tight across all price points in the fourth quarter, and unit sales also decelerated. Coming after an exceptional year of strong sales and price appreciation that ranked among the highest in the nation, the slowdown was predictable — even beyond the expected holiday relaxation factor. Still, single-family homes and condominiums that were fairly priced sold quickly, with many receiving multiple offers.

Fourth-quarter sales activity was not as frenzied as in past quarters, but the positive economic fundamentals of the San Francisco market remain unmatched: one of the most desirable locations in the nation, an expanding job base, and economic growth that shows little sign of slowing down.

Looking Forward: The year 2015 should shape up to be another busy one for buyers and sellers. We expect to see inventory levels rise appreciably in the first quarter; sales prices will also continue to rise, although not likely at the pace seen in 2014. Mortgage rates hovered near record lows throughout 2014 but are likely to succumb to upward-force vectors in 2015 — an added incentive for buyers to close deals early in the year to lock in low rates.

SILICON VALLEY

October and November were exceptionally strong months for real estate activity in Pacific Union’s Silicon Valley region, but sales dropped off a ledge after the last week of November. December was as slow as the previous months were busy. Inventory remained flat throughout the quarter, while the average sales price continued rising. Many homes attracted multiple offers from buyers, but not at the levels seen in previous quarters. Overall, buyers started to regain some control on the market, holding back on bidding for overpriced homes.![]()

With home prices in Palo Alto, Menlo Park, and nearby communities starting at $2 million and $3 million, we saw a migration of buyers — first-time buyers in particular — to more affordable areas such as Redwood City and San Carlos, where improving schools and more vibrant downtowns have helped increase their desirability.

Looking Forward: We expect business to pick up again in January, with rising inventory levels and renewed interest among both buyers and sellers thanks to the Bay Area’s strong economic growth. The likelihood of mortgage rates trending significantly higher later this year will be a strong impetus for buyers to close deals.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the report charts includes all single-family homes in these communities.

Defining the Mid-Peninsula: Our real estate markets in the Mid-Peninsula subregion include the cities of Burlingame (excluding Ingold Millsdale Industrial Center), Hillsborough, and San Mateo (excluding the North Shoreview/Dore Cavanaugh area). Sales data in the report charts includes all single-family homes in these communities.

SONOMA COUNTY

The last quarter of 2014 bore remarkable similarities to the first quarter in Sonoma County, with a constrained supply of available homes and a ready pool of would-be buyers. Many sellers continued to receive multiple offers on well-priced properties, although bidding activity was not as frenetic as it was at the start of the year, and price appreciation has slowed considerably from the double-digit percentage increases that had become commonplace.

Even with the limited supply, buyers in the fourth quarter no longer bid as franticly on overpriced properties or those with problems as they might have as recently as six months ago. This change in attitude caught some sellers by surprise, but it reflects the growing normalization of the market as buyers began to show some signs of price resistance, especially at the higher end of the market.

The fourth quarter saw fewer sales of homes priced below $500,000, reflecting the virtual disappearance of distressed properties such as short sales and foreclosures on the market.

Looking Forward: Sonoma County may see fewer sales overall in the first quarter, but dollar volume will continue rising as buyers choose from more high-end homes on the market. Springtime is always a busy season for real estate, and 2015 will be no different.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the report charts includes all single-family homes and farms and ranches in Sonoma County.

SONOMA VALLEY

Pacific Union’s Sonoma Valley region saw strong sales throughout the fourth quarter. There was no shortage of would-be buyers, and well-priced properties in good condition continued to attract multiple offers.

In a change from past quarters, buyers started to gain an upper hand in negotiations with sellers, a sign of a normalizing real estate market. Once buyers completed due diligence, they weren’t shy about asking for concessions or repairs, and sellers found that they had to be more careful in pricing their homes — some with unrealistic expectations found themselves sitting on properties far longer than they would have even six months earlier.

Homes sold well across Sonoma Valley and at all price points, but especially those that were priced under $750,000. Inventory remained exceptionally tight.

Looking Forward: The year 2015 looks to be a busy one for buyers and sellers in the Sonoma Valley region. With a strong Bay Area economy and mortgage rates still hovering near record lows, the first quarter should be exceptionally active. We recommend that sellers not wait until the spring to put their properties on the market. Buyers are active year-round, and those properties on the market in January, February, and March face less competition and will stand out.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the report charts refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

LAKE TAHOE/TRUCKEE

The fourth quarter is traditionally a busy time in Pacific Union’s Lake Tahoe/Truckee region, as out-of-town buyers — many from the Bay Area — shop for vacation homes in time for the coming ski season. This year was no different, helped by several high-end sales at the end of the year. Sales were particularly brisk in Martis Camp and the Village at Squaw Valley, as well as for homes priced above $1 million across the region.

Unlike in the Bay Area, the Lake Tahoe/Truckee region had an ample supply of homes at various price points in the fourth quarter, giving buyers an opportunity to find exactly what they were looking for. Attractive homes that were fairly priced were subject to multiple offers, but properties with unrealistically high prices typically sat on the market for months on end without a single bid.

Looking Forward: First-quarter home sales in the Lake Tahoe/Truckee area are influenced by the weather; all it takes is a good snowstorm or two for Bay Area residents to pack their skis and head for the Sierras. If the weather cooperates, we look forward to a busy winter and spring. And as the snow recedes, we expect to see a healthy supply of new listings hit the market.

Defining Lake Tahoe/Truckee: Our real estate markets in the Lake Tahoe/Truckee region include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the report charts includes single-family homes and condominiums in these communities.