In the final month of the second quarter, the median sales price for a single-family home rose year over year in seven of Pacific Union’s Northern California regions. Single-family home prices reached yearly highs in the East Bay, San Francisco, and Sonoma County, while condominium prices in San Francisco eclipsed the $1 million mark.

Inventory remained tight across the Bay Area throughout the second quarter, with most of our regions experiencing declines from April to June. Still home shoppers in some local markets got a smidgen of relief, as inventory expanded slightly throughout the quarter in San Francisco, Sonoma Valley, and the Mid-Peninsula portion of our Silicon Valley region.

Pacific Union’s second-quarter 2014 report is packed with data and regional summaries that offer a full picture of real estate activity in the Bay Area and the Tahoe/Truckee region.

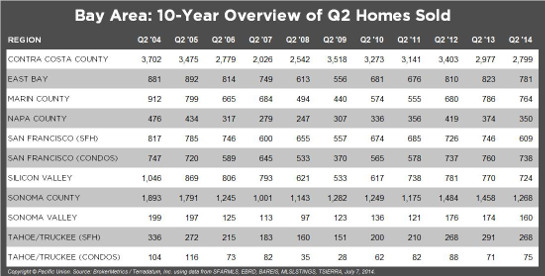

Our Q2 Report also includes a comprehensive chart tracking 10 years of home sales throughout the Bay Area and Tahoe/Truckee — 76 cities, towns, and neighborhoods in nine regions. A smaller version of that chart, showing regional totals, appears below. Click anywhere on the chart to see the full data set.

Below are some specifics on what’s happening in our regional real estate markets. For further information, including detailed charts, please view our complete Q2 Quarterly Real Estate Report.

CONTRA COSTA COUNTY

After many months of frustratingly low inventory levels, Pacific Union’s Contra Costa County region saw a significant increase in the supply of available homes for sale in the second quarter. Having regained equity in their homes, sellers made the decision to move during the quarter, some in order to be in their next homes before their children start school in the fall.

Home prices rose by double digits from a year ago, and properties generally sold slightly above their list prices. That’s good news for sellers, but it pushed some first-time buyers out of the market. Being outbid time and again in multiple-offer situations also discouraged some buyers, although the increase in inventory has tempered the frenetic pace of bidding we saw in 2013. In the second quarter, many homes attracted a handful of offers – not the dozen or more that were commonplace last year.

Looking Forward: Real estate activity typically slows during the summer, and the third quarter of 2014 will be no different. Home prices will continue to rise moderately through the end of the year, and a steady increase in inventory will reduce the instances of multiple offers, though the most desirable homes will continue to spark bidding wars.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Danville, Diablo, Lafayette, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the charts below includes single-family homes in these communities.

EAST BAY

Even with a noticeable and welcome increase in inventory, demand continued to outstrip the supply of available homes for sale in Pacific Union’s East Bay region during the second quarter of 2014. The majority of homes on the market garnered multiple offers, particularly those in the most desirable neighborhoods. Overall, however, the number of offers and the pace of bidding slowed somewhat in the last half of the quarter.

Home prices continued to rise during the quarter, with those in the $500,000-to-$1 million range attracting the most attention from buyers. The most competitive neighborhoods were those rated the most walkable near BART, restaurants, and shops.

Besides offering new options to frustrated buyers, the increase in listings suggests that sellers have regained equity in their homes and are optimistic that they can successfully trade up to their next property.

Looking Forward: The East Bay remains an attractive destination for homebuyers priced out of the superheated San Francisco market. Even with an expected seasonal slowdown in the summer months – a consequence of school breaks and summer vacations – we expect continued strong sales throughout 2014.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the charts below includes single-family homes in these communities.

MARIN COUNTY

Second-quarter real estate activity in Pacific Union’s Marin County region was, in a word, phenomenal. Buyers were eager and plentiful, and sellers – motivated by steadily rising home prices and restored equity over the past year – increasingly made the decision to cash out or move up. Some baby boomers downsized their homes, thereby boosting their retirement funds.

Buyer demand remained exceptionally strong in the second quarter, which doesn’t indicate a bubble but rather reflects long-term growth in the market. Marin County remains a key Bay Area destination, and buyers continued to outnumber the supply of available homes. The most active markets were for high-end homes in communities such as Mill Valley, Ross, and Kentfield.

Looking Forward: The summer months typically bring a slowdown in activity, as buyers’ thoughts turn to vacations instead of real estate. However, the Bay Area’s booming economy virtually guarantees that Marin County real estate will continue to command high interest from buyers. List prices will likely stabilize in the third and fourth quarters, although multiple offers for the most desirable homes will continue to push final prices higher.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the charts below includes single-family homes in these communities.

NAPA COUNTY

After a slow first quarter, real estate activity in Pacific Union’s Napa County region picked up noticeably in April, performed even better in May, and shot off the charts in June. The second quarter of 2014 saw a large increase in the supply of available homes, and buyers were waiting; as soon as a well-priced property came on the market, it sold.

All price points saw strong sales activity across the county, with exceptional demand for winery properties and vacant land suitable for development. Distressed properties – short sales and bank-owned homes – have virtually disappeared from the marketplace after accounting for half of all sales just a few years ago. Home prices have stabilized, and multiple offers, a staple of nearly all sales last year, have waned. In short, Napa County’s real estate markets have largely returned to normalcy after a tumultuous seven years of boom, bust, and recovery.

Looking Forward: The third quarter looks to be an active time for homebuying and selling, even though sales typically slow a bit after schools let out for the summer and families pursue vacations. Plenty of buyers will be watching – and bidding – in the months ahead.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the charts below includes all single-family homes in Napa County.

SAN FRANCISCO

One year ago the San Francisco real estate market was on fire, as the region came roaring back from the recession and housing downturn, yielding exceptionally strong sales in virtually every market and neighborhood and at all price points. Fast-forwarding to the second quarter of 2014 we saw largely the same story: Demand for San Francisco single-family homes and condominiums showed little sign of cooling.

The supply of available homes rose modestly during the quarter, but aggressive bidding and multiple offers remained typical for almost all fairly priced properties. Median home prices continued to climb higher, with final prices routinely topping list prices by 10 percent or more –a welcome bonus for sellers. The Mission District remained particularly popular with buyers, thanks in part to its prime location, wealth of transportation options, and abundant supply of vintage housing.

Looking Forward: San Francisco’s strong real estate market does not appear to be weakening. Home prices will likely continue to rise moderately, and we expect to see more properties gradually hit the market. As one of the nation’s most popular relocation destinations due to a booming regional economy, San Francisco will continue to provide plenty of opportunities for both buyers and sellers.

SILICON VALLEY

Spring is typically a brisk season for real estate, but second-quarter activity in Pacific Union’s Silicon Valley region was even busier than usual. Tech-industry workers and foreign buyers helped spur the activity, including a nonstop rise in sale prices. Just a few years ago, homes in the market’s “sweet spot” sold for $1.1 million to $1.7 million; today, those same homes command between $1.5 million and $2.5 million, and they go into escrow as soon as they hit the market.

High-end homes continued to sell well, with many buyers paying all cash for properties priced at $10 million and higher. An estimated 25 percent of sales in the region were “off-market” – private transactions that never appeared on an MLS.

Off- MLS sales are controversial because, while buyers and sellers can avoid the tumult of open houses and bidding wars, a prearranged price can mask a home’s real value. Buyers, for example, may pay many thousands above asking price for a home listed on the open market. On the other hand, sellers may settle for a price far below what a home is worth in an off-MLS transaction.

Looking Forward: The third quarter in Silicon Valley looks to be busy, although not as hectic as the second. Homes generally attracted fewer multiple offers in the second quarter than in the first, and we expect that trend to continue.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the charts below includes all single-family homes in these communities.

Defining the Mid-Peninsula: Our real estate markets in the Mid-Peninsula subregion include the cities of Burlingame (excluding Ingold Millsdale Industrial Center), Hillsborough, and San Mateo (excluding the North Shoreview/Dore Cavanaugh area). Sales data in the charts below includes all single-family homes in these communities.

SONOMA COUNTY

After a slow start in the first quarter, home sales in Pacific Union’s Sonoma County region picked up significantly in the second quarter as more, higher-priced inventory arrived on the market. After sitting on the fence for years, sellers saw equity levels rise substantially and decided the time was right to get in the game. Buyers, meanwhile, were anxious to take advantage of the expanded supply. Many homes received multiple offers, but typically two or three per property – not the 10 or 12 bids seen over the past year.

The median sales price rose moderately, but less because of appreciation and more because of the changing nature of home sales. A few years ago the Sonoma County market consisted mostly of short sales and foreclosures, whereas today they account for 10 percent or less of sales. Equity sales and higher-priced properties are currently predominant as the housing recovery advances and the market returns to normalcy.

Looking Forward: As long as the inventory of available homes continues to rise, we expect continued growth in the region. Demand for homes will not be as frantic as we’ve seen over the past year, but it still runs deep. We look forward to a strong second half for 2014.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the charts below includes all single-family homes and farms and ranches in Sonoma County.

SONOMA VALLEY

Sellers in Pacific Union’s Sonoma Valley region tended to keep their properties off the market during the winter and early spring months, waiting for gardens and flowerbeds to bloom in order to present their homes in the best light. That decision created a substantial increase in listings during the latter part of the second quarter. Additionally, sellers put overly optimistic prices on their homes – higher it seems than the market would bear – and the strategy backfired. By the end of the second quarter many sellers had reduced prices, and homes were staying on the market longer than expected.

Nonetheless, it was a busy quarter. Some sellers found themselves in the unusual position of competing for buyers, who got to choose from a more robust mix of homes. Well-priced properties continued to attract multiple offers, although far fewer than the dozen or so that we saw last year.

There was even a bit of a sales lull for midpriced homes in May before activity regained steam in June, and what began as a boom in the beginning of the year for multimillion dollar properties has now softened considerably. It remains to be seen as to whether this is just another cyclical event or a correction in the market as a whole.

Looking Forward: With a strong market in second-home sales, Sonoma Valley real estate is closely tied to the Bay Area’s economy. Forecasts call for robust economic growth well into next year, suggesting plenty of opportunities for both buyers and sellers.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the charts below refers to all residential properties – including single-family homes, condominiums, and farms and ranches – in these communities.

TAHOE/TRUCKEE

Real estate activity operates on a different timetable in Pacific Union’s Tahoe/Truckee region than in the Bay Area. Whereas the second quarter is a beehive of activity for Bay Area homebuyers and sellers, it is the quietest time of the year in the Tahoe/Truckee region, with skiers gone home and summer vacationers not yet arrived.

That calm was a boon for second-quarter homebuyers in the region, who had an ample supply of homes from which to choose. Sellers, meanwhile, saw prices rise steadily amid pent-up demand for single-family homes and condominiums. Properties that were fairly priced sold quickly.

Tahoe/Truckee is primarily a second-home market, closely linked to the Bay Area’s economic health (as well as that of Sacramento and Reno), and the recession and housing-market troubles of recent years took a toll on the region. After more than a year of recovery, however, Tahoe/Truckee returned to a balanced market in the second quarter, with plenty of inventory and hopeful buyers alike.

Looking Forward: The third quarter is prime time for the Tahoe/Truckee real estate market, as vacationers pull double duty as homebuyers. With the Bay Area economy showing no signs of slowing, we expect to see increasing numbers of residents choose to invest in Tahoe/Truckee real estate.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the charts below includes single-family homes and condominiums in these communities.