Median home prices hit yearly highs in most of Pacific Union’s regions as the first quarter drew to a close, including Contra Costa County, the East Bay, Marin County, Napa County, Silicon Valley, and Sonoma County. Single-family home prices in San Francisco dipped a bit in March from the previous month but still topped the $1 million mark, while condo prices were nearly as high.

Constrained inventory, which was typical in most Bay Area locales in 2013, likely played a key role in the price increases. Inventory dropped from February to March in each one of our markets except for Napa, where it held steady, and Sonoma Valley, where it slightly expanded. As spring approached, more single-family homes appeared on the market in our Tahoe/Truckee region, though condo inventory shrank month over month in March.

Pacific Union’s first-quarter report is packed with data and regional summaries that appear to foreshadow a busy springtime selling season in 2014.

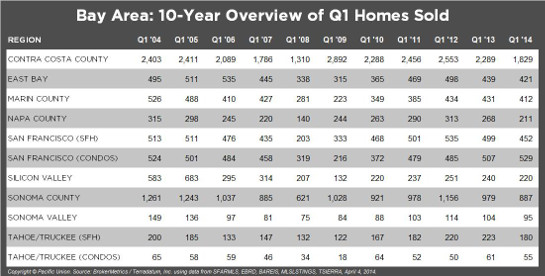

Our Q1 Report also includes a comprehensive chart tracking 10 years of home sales throughout the Bay Area and Tahoe/Truckee — 75 cities, towns, and neighborhoods in nine regions. A smaller version of that chart, showing regional totals, appears below. Click anywhere on the chart to see the full data set.

Below are some specifics on what’s happening in our regional real estate markets. For further information, including detailed charts, please view our complete Q1 Quarterly Real Estate Report.

CONTRA COSTA COUNTY

The first quarter of 2014 started slowly in Pacific Union’s Contra Costa County region as a shortage of homes on the market held back sales. Inventory gradually loosened throughout the quarter, and by the end of March we saw a double-digit increase in home sales – solid performance during the typically slow winter season.

Relaxed loan standards and an increase in jumbo loans helped spur sales in the market for homes priced at $1 million to $1.4 million – a significant share of Contra Costa County properties – with many selling above list price. The market for higher-priced homes up to $4 million also saw sales climb significantly higher throughout the quarter, as foreign investors and tech-industry executives increasingly were drawn to the region’s attractive homes and excellent schools.

Looking Forward: We expect to see a slight increase in inventory in the coming months, but well-staged homes that are competitively priced will still get multiple offers. The average sales price will rise moderately, perhaps 5 percent through the second quarter. With mortgage rates expected to stay at historically low levels for at least the next several months, the second quarter should be quite robust.

Defining Contra Costa County: Our real estate markets in Contra Costa County include the cities of Alamo, Blackhawk, Concord, Danville, Diablo, Lafayette, Martinez, Moraga, Orinda, Pleasant Hill, San Ramon, and Walnut Creek. Sales data in the charts below includes single-family homes in these communities.

EAST BAY

Pacific Union’s East Bay region saw a steady supply of listings appear on the market in the first quarter, but it wasn’t nearly enough to meet buyer demand. Homes sold within weeks of their first appearance on the MLS, often for more than 20 percent above asking prices in the most competitive neighborhoods.

The East Bay remained an attractive destination for homebuyers priced out of the San Francisco market. All-cash buyers had a significant advantage over those relying on bank financing, but competition was fierce among all buyers and at all price points. The tight supply ensured that virtually all homes that were attractive and fairly priced received multiple offers.

Looking Forward: Springtime is the busiest real estate season, and we are confident that the inventory of available homes will expand in the second quarter, helping to ease the frenetic pace of bidding among buyers. We expect to see a steady increase in both sales and prices, although outside factors such as rising interest rates could affect the market.

Defining the East Bay: Our real estate markets in the East Bay region include Oakland ZIP codes 94602, 94609, 94610, 94611, 94618, 94619, and 94705; Alameda; Albany; Berkeley; El Cerrito; Kensington; and Piedmont. Sales data in the charts below includes single-family homes in these communities.

MARIN COUNTY

The supply of available homes remained exceptionally tight in Pacific Union’s Marin County region during the first quarter. Continuing a trend that has frustrated many buyers, bidding wars escalated for most properties, and final sales prices climbed far beyond listing prices. As a general rule, buyers with a $1.5 million budget instead focused their searches on $1.3 million properties and spent the difference on sweetened offers.

Homes that came on the market in the first quarter quickly went into contract, with all-cash buyers clearly having an edge over those relying on bank financing. The first quarter also saw a growing number of private purchase agreements, reached without the home ever appearing on the MLS and without competing bids. Such private deals can simplify the sales process for sellers but don’t guarantee the highest possible prices.

Looking Forward: All signs point to a busy spring and summer, although the supply of homes will remain tight until sellers realize the substantial price premiums homes are commanding in the current market. It has been many years since our Marin County region was so favorable to sellers.

Defining Marin County: Our real estate markets in Marin County include the cities of Belvedere, Corte Madera, Fairfax, Greenbrae, Kentfield, Larkspur, Mill Valley, Novato, Ross, San Anselmo, San Rafael, Sausalito, and Tiburon. Sales data in the charts below includes single-family homes in these communities.

NAPA COUNTY

Home sales in Pacific Union’s Napa County region slowed in January and February, following seasonal norms, but began picking up again in March as the spring buying season approached. The inventory of available homes for sale remained tight throughout the first quarter. Multiple bids were seen at all price points, but especially in the $400,000-to-$550,000 price range. Compared with the second and third quarters of 2013, however, multiple offers were down in number.

A more significant change in first-quarter sales activity involved a surprising number of homebuyers who backed out of purchases just a few days after signing sales contracts – evidence of sticker shock, perhaps. Sellers, too, were more cautious, with many insisting on contingency sales in which they could cancel a deal if they couldn’t find a new home themselves. The changing dynamics are a sign that Napa County real estate is slowly moving to a more familiar move-up buyer market.

Looking Forward: We expect to see a substantial number of homes hit the market in the second quarter of 2014, along with a new rush of buyers. Napa County homes look their best with flowerbeds and gardens in full bloom, and we look forward to busy second and third quarters.

Defining Napa County: Our real estate markets in Napa County include the cities of American Canyon, Angwin, Calistoga, Napa, Oakville, Rutherford, St. Helena, and Yountville. Sales data in the charts below includes all single-family homes in Napa County.

SAN FRANCISCO

First-quarter real estate activity in San Francisco was, in a word, unbelievable. The winter months usually see a slowdown, but an exceptionally tight inventory of homes on the market resulted in frenetic bidding activity for properties at all price points and in all neighborhoods. With multiple offers for most properties, sales prices reached record highs.

A snapshot of first-quarter sales shows bidding at a new condominium development in the Mission District climb to $1,400 per square foot, reaching prices that previously were seen only on the city’s north side. A newly renovated tenancy-in-common on Nob Hill also achieved prices above $1,400 per square foot.

Even with the promise of generous prices, sellers were reluctant to put their homes on the market because they’re not sure where they will find their next home in the current tight market. Meanwhile, the booming economy in San Francisco – where tech-sector jobs have increased 53 percent since 2010 – helped ensure an increasing pool of buyers.

Looking Forward: San Francisco will remain a superheated market until the inventory of homes expands considerably – when sellers take advantage of a market weighted in their favor. When that happens, buyers will be waiting.

SILICON VALLEY

The supply of homes on the market in Pacific Union’s Silicon Valley region remained tight in the first quarter, but there was no shortage of buyers. The combination produced no appreciable rise in sales, although final prices jumped substantially higher. Most homes received multiple offers, but the pace of bidding wasn’t as hectic as in previous quarters. Buyers were most attracted to homes priced between $1.2 million and $2.2 million. ![]()

One consequence of the limited supply of inventory was an increased number of private purchase agreements between a buyer and seller without ever having listed the home with a local MLS and without any competing bids. We estimate that such agreements were responsible for more than 25 percent of all Silicon Valley home sales in the first quarter. While such transactions can simplify the sales process for sellers, they don’t guarantee the highest possible prices.

Looking Forward: The second quarter is shaping up to be a busy homebuying season in Silicon Valley. Sellers have been slow to put their properties on the market, but we believe that will change as they become aware of the substantial increase in value over the past year.

Defining Silicon Valley: Our real estate markets in the Silicon Valley region include the cities and towns of Atherton, Los Altos (excluding county area), Los Altos Hills, Menlo Park (excluding Alpine Road area and east of U.S. 101), Palo Alto, Portola Valley, and Woodside. Sales data in the charts below includes all single-family homes in these communities.

SONOMA COUNTY

First-quarter home sales started slowly in Pacific Union’s Sonoma County region, but as the inventory of available houses began to come to market, the velocity of sales picked up accordingly. By the end of March, a familiar pattern had emerged: Buyer demand outstripped the supply of homes, bidding wars were commonplace, and sales prices rose significantly.

Homes at lower price points saw the strongest demand, but limited availability held back sales. A surplus of distressed properties supplied the lower end of the market in recent years, but that stream has since slowed to a trickle. With real estate activity moving upmarket, sales during the first quarter were strongest in the $400,000-to-$600,000 range and homes priced $1 million and higher. Sales velocity remained strong across all price points, however, and as soon as a well-priced property came on the market, it quickly went into escrow.

Looking Forward: Sonoma County’s real estate markets are entering a period of continued equity growth. Increased demand, and limited supply, over time will favor sellers. We expect buyer demand to remain exceptionally strong. Sellers, after more than a year of regaining equity, may find new incentives to put their homes on the market. We look forward to a busy spring and summer.

Defining Sonoma County: Our real estate markets in Sonoma County include the cities of Cotati, Healdsburg, Penngrove, Petaluma, Rohnert Park, Santa Rosa, Sebastopol, and Windsor. Sales data in the charts below includes all single-family homes and farms/ranches in Sonoma County.

SONOMA VALLEY

There was no winter slowdown in sales activity in Pacific Union’s Sonoma Valley region, with plenty of buyer interest throughout the first quarter. The supply of homes for sale stayed historically low for much of the quarter before a large influx of new listings appeared during the final weeks of March.

Homeowners seemed reluctant to put their homes on the market because they were unsure they could find a replacement home themselves. However, as sellers have begun to realize equity in their properties, they are gaining confidence in the market and seem ready to finally move on.

Sales in the first quarter were strong across all price points in the region, particularly for homes priced less than $1 million. Most buyers purchased homes as primary residences, but second homes and vacation getaways were popular options, too. Investor interest has declined in recent quarters as home prices and mortgage rates climbed higher.

Looking Forward: Many sellers have been waiting for gardens and flowerbeds to bloom in order to present their homes in the brightest light. The added inventory guarantees strong buyer interest and robust sales through the spring and summer months.

Defining Sonoma Valley: Our real estate markets in Sonoma Valley include the cities of Glen Ellen, Kenwood, and Sonoma. Sales data in the charts below includes single-family homes, condominiums, and farms/ranches in these communities.

TAHOE/TRUCKEE

It’s an open question whether visitors to Pacific Union’s Tahoe/Truckee region during the first quarter were there primarily to ski or to buy vacation homes.

Real estate activity was unusually busy throughout the quarter. Buyers, typically most active in the spring and summer months, wasted no time this year to shop the region’s supply of cabins, condominiums, and expansive Sierra retreats. Homes that were fairly priced promptly received multiple offers, with particular interest in higher-end properties.

Tahoe/Truckee is predominantly a second-home market, and it seemed as if buyers, after several years of caution, collectively decided the time was right to purchase property in the region again. Sellers were not as quick to the market as buyers, although by the end of the quarter we saw a gradual increase in inventory and moderate price gains.

Looking Forward: From all indications, the second quarter of 2014 will be incredibly active across all price ranges in Tahoe/Truckee. Many sellers are preparing to put their homes on the market this spring, and buyers will be waiting. We expect that fairly priced homes will still attract multiple offers.

Defining Tahoe/Truckee: Our real estate markets in Tahoe/Truckee include the communities of Alpine Meadows, Donner Lake, Donner Summit, Lahontan, Martis Valley, North Shore Lake Tahoe, Northstar, Squaw Valley, Tahoe City, Tahoe Donner, Truckee, and the West Shore of Lake Tahoe. Sales data in the adjoining chart includes single-family homes and condominiums in these communities.