Pricing is Critical to Maximizing Sellers Proceeds!

The national and international news we are exposed to daily has been consistently volatile for the past three-to-four years. Q3 ’11 marked both the worst quarter since ’09 for the Dow Jones Industrial Average and a 160% increase in the VIX (volatility index). In Fall 2008, we experienced similar economically jarring news temporarily (October – February 2008) stalling our local Bay Area real estate markets.

The good news is real estate is a local business! We do not necessarily follow, react or respond to national trends. While our clients’ confidence, job security and investment strategies are very much influenced by national and international news stories, our local real estate results are fairly stable and certainly do not reflect the volatility of the national, international, political or economic unrest.

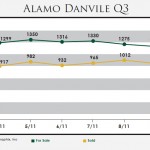

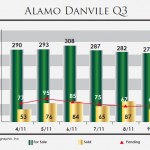

It is our feeling that Hwy 24/680 corridor housing prices will remain fairly stable for the next 15 – 18 months. We expect mortgage rates to remain in the five-percent (5%) range (in some loan products lower). We have certainly benefited from more realistic sellers in the marketplace. This may be a result of access to plenty of meaningful comparable sales in the market as well as great examples of over-priced homes. Time on the market is clearly not a seller’s friend – statistics from the MLS confirm that though inventory in Alamo and Danville is high, only 25% of those homes are going into contract, and in those areas the number of closed transactions is the lowest since April of this year. September’s average sales price for homes in Alamo and Danville dropped 3%.

Blackhawk is following Danville and Alamo with slightly higher inventory, but 40% fewer sales over August. The average price of the homes that are selling and closing is down 16% over April, 2011 indicating that sellers are reluctant to accept the market price, or buyers are still perceiving a downward pricing trend in Blackhawk.

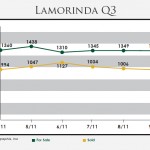

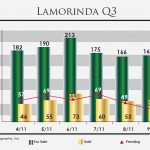

The Lamorinda area is fairly better with the average sold price down 3% since April and the average listed price staying flat at $1.352. Inventory is up slightly over August, but buyers are hesitant to write offers. The number of pending sales is down 29% over the number in August.

Buyers in the Contra Costa real estate market are very well educated, conversant on recent sales and new listing inventory. We find buyers to be generally patient, focused, seeking value and not willing to make offers on overpriced listings. This makes the pool of qualified buyers keenly focused on the best priced inventory. Most buyers are approaching the primary home market as an investment in their home vs. speculation on an appreciating housing market.

We entertain ourselves internally by saying we feel like it has been Groundhog Day every day for the past three years. However volatile the national and international news may be, we still see opportunity in our market every day for buyers and sellers. Real estate is a very local business – we have micro-markets in Contra Costa County neighborhoods that are far more robust than others.

Click the charts below to enlarge.