Work From Home — Day 70

Crazy Busy & The Tunnel

5:05AM PST

Team –

This was likely the craziest busy weekend of real estate I can remember [established 2006]. Buyer demand is furious and coming to your community from every vantage point. Buyers seem to be:

- Fleeing rentals, trading up, seeking yards, pools and solitude.

- Seeking quality schools, sense of smaller communities, resort-like properties and pools [again].

- The migration from urban areas:

- Los Angeles to beach communities on the Westside, and Santa Barbara.

- San Francisco to East Bay, Marin, Wine Country, and Silicon Valley communities with amazing school districts.

- Anything “done” under $2 million is seeing multiple offers.

- The high-end is seeing multiple offers at $3 million, $5 million and +$10 million throughout California. Not so much at “list price” but we predicted this softness.

- The activity in the City of San Francisco over $5 million seems to be move up buyers. If you love San Francisco, get a better home and love San Francisco more.

- In Beverly Hills and Brentwood, it seems to be the same “love it more” buyer over $5 million.

- The entertainment and production industries are negotiating with Unions to get back to work. This could unleash another wave of buyers.

- Births, engagements, divorce, death, and downsizing are all happening as well.

The demand is ferocious in every aspect of the business. It seems like every real estate season and every buyer demand all in one weekend.

In our second home markets, the conversations have gone from “I’d love to rent a high-end home” and check the area out to “I need a home / I am buying a home” for the quality of my life. This is where I want to live!

SIP has defined a sense of home in a way we have never experienced. Top to bottom. Price point does not seem to matter, except for some high-end communities.

Bring it on safely!

I am concerned about the states that have “opened up.” Beaches, restaurants, bars, tattoo parlors, etc. are in full social engagement. As you have stated in our surveys, your primary concern post-SIP is “the behavior of others.” Please remember to set your personal best behavior in this journey. As I shared with you last week, “mother nature bats last and she bats 1,000” – Dr. Thomas Frieden.

Robert and I were communicating last week, just after his excellent CNBC interview. He asked, “How long are you [Mark] going to continue your daily emails?” My answer was “until our offices open.”

I have written my last two emails already. They are about overcoming adversity. These two stories have never been told. They are real, vulnerable and inspiring.

This has been an amazing and challenging journey for all of us. If we are socially and healthy smart, we will see an end to this tunnel.

Between now and then, in this period of intense demand, we need to be safe as priority #1. We do not want to see SIP – the sequel.

My mom and dad came by this weekend. My dad so eloquently described the “light at the end of the tunnel.” Generally, we accept this as a positive perspective. It’s the way we are wired. See and chase the light!

This COVID-19 tunnel is dangerous. I’m not sure it’s time to enter the tunnel.

Be safe!

This is Where We Are Now.

Thanks!

Mark

Mark A McLaughlin

Work From Home — Day 70 — Closing Bell

Weekend Snapshot + 77 Units

4:55PM PST

Team –

Anecdotally, this morning’s e-mail was optimistic about our weekend activity. Now for the facts.

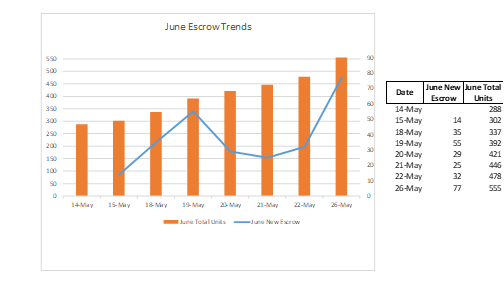

June units booked to date are approaching 600. In a normal market [SIP is not], this would translate to a forecast of 1,000 units closed in June. June 2019, we closed 885 units at $1.64 average sales price.

Here is a snapshot of our momentum. Up and to the right!

The orange bars are total June forecasted units as indexed to the left axis. The blue line is daily new units for June closings as indexed to the right axis. The two spikes are last Tuesday and this Tuesday, largely reflective of weekend activity. This week, we expect a robust new opening pace for tomorrow paperwork makes its way to our finance team.

We will have a more detailed report on pending, closings, and cancellations on Thursday afternoon.

Thanks for all you are doing. The results are very encouraging.

This is Where We Are Now.

Thanks!

Mark

Mark A McLaughlin