Here’s a look at recent news of interest to homebuyers, home sellers, and the home-curious.

WHAT WOULD IT COST TO BUY ALL OF SAN FRANCISCO AND SILICON VALLEY?

If buying even one home in the pricey San Francisco real estate market seems like a tall order, imagine what it would cost to buy every residence in the city.

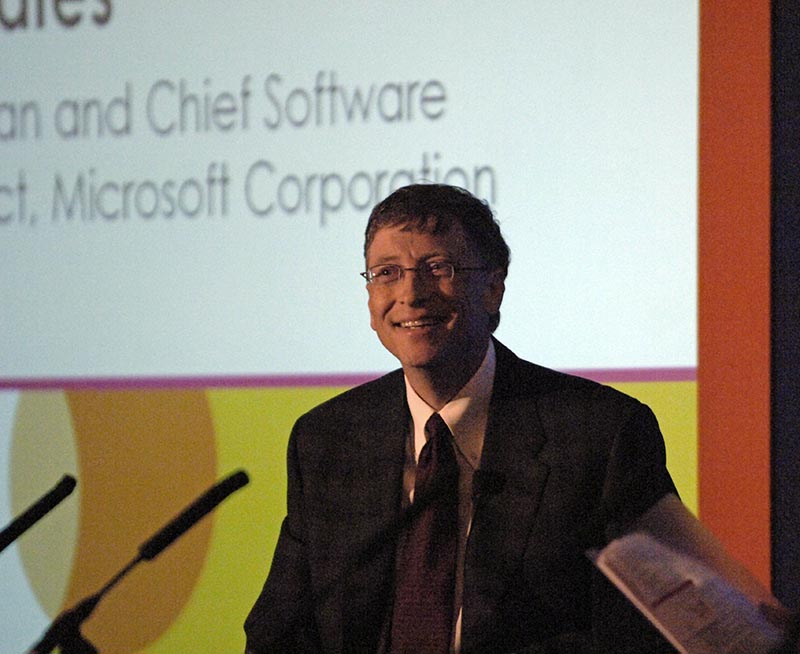

That would be almost $166 billion, the total value of all residential properties in the city, according to a recent report by PropertyShark. If Bill Gates and Warren Buffett — the planet’s two wealthiest men — pooled their fortunes, their total $158 billion could almost buy all homes in San Francisco.

Facebook’s Mark Zuckerberg already owns several homes in Palo Alto, but he could buy all properties in the city with his $51 billion stash. That would also cover each and every home in nearby and even more expensive Los Altos Hills. As of November, the median sales price for a single-family home in Palo Alto and Los Altos Hills was $2.51 million and $3.72 million, respectively, according to MLS data.

The total property value of all homes in Silicon Valley — which for the purpose of PropertyShark’s analysis includes most of San Mateo, Santa Clara, and Alameda counties — comes to a staggering $846 billion. It would take the combined fortunes of the 18 wealthiest people in the world, including Bay Area tech heavyweights Larry Page, Sergey Brin, and Larry Ellison, to buy every home in all 33 major cities in the region. PropertyShark notes that the combined values of Google and Facebook would also more than cover the costs of buying every residential property in Silicon Valley.

THREE OF NATION’S 10 LARGEST HOME OVERBIDS OF THE YEAR IN SAN FRANCISCO

Bidding wars have become old hat to home shoppers in San Francisco and other sought-after Bay Area cities, but a select few are willing to really pony up big time in order to close a deal.

OpenHouse’s list of the 10 largest U.S. home premiums paid so far this year puts the largest overbid in Beverly Hills, where a 4-bedroom home that listed for $8,795,000 eventually sold for more than $16 million — an 84 percent premium. Eight of the 10 homes on the list are located in California, while Washington and Florida were responsible for one each.

Three of those hefty overbids happened in San Francisco, the largest of which is a Presidio Heights home that sold for $11.3 million, almost $4 million more than list price. A Pacific Heights home just north of Alta Plaza Park sold for $11 million, about $3 million above list. And an investor hoping to cash in on the city’s high-dollar rental market paid $24.5 million for a 48-unit building just a few blocks from Union Square..

AFFORDABILITY, INVENTORY CONSTRAINTS CHALLENGING FIRST-TIME BUYERS

Affordability has stalled purchases by first-time buyers, but cooling price appreciation may help more of them enter the market in 2017.

A Construction Dive briefing says that first-time homebuyer activity dropped by 12.1 percent year over year in the third quarter, the largest such decline in three years. First-time buyers spent nearly 40 percent of their incomes to purchase the median-priced home, compared with 25.5 percent for move-up buyers and 13.9 percent for luxury buyers.

Higher mortgage rates that will result from last week’s Federal Reserve decision could actually help some first-time buyers by moderating price appreciation. The National Association of Realtors projects that U.S. home prices will rise by 3.9 percent next year. At Pacific Union’s recent Real Estate and Economic Forecast, we predicted that home price gains over the next three years will range from 11 percent in Napa County to 3 percent in Alameda and Contra Costa counties.

(Photo: Flickr/IAB UK)