Audio Introduction: East Bay-Alameda County Third Quarter at a Glance

[audio:/wp-content/uploads/EastBayThirdQuarter-ReportIntroduction3.mp3|titles=EastBayThirdQuarter-ReportIntroduction]All Real Estate is Local

The national and international news has been volatile for the past three to four years. The third quarter 2011 marked both the worst quarter since 2009 for the Dow Jones Industrial Average and there was a 160% increase in the volatility index, the VIX. In the fall of 2008, jarring economic news precipitated a temporary lull in local real estate activity that lasted from October through February, 2009.

However, because real estate is a local business, Our markets do not necessarily follow, react or respond to national trends. While our clients’ confidence, job security and investment strategies are influenced by national and international news, our local real estate activity appears to be holding fairly stable and does not reflect the volatility of the national and international political and economic unrest. In fact, our analysis of the Bay Area real estate market suggests that housing prices in our area will remain fairly stable for the next 15 to 18 months. And we expect mortgage rates to remain in the 4% to 5% range or even lower for certain types of loans.

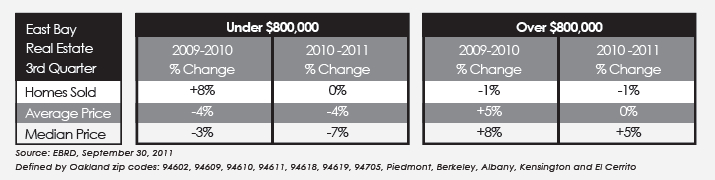

This fall’s average and median sale prices reflect changes within plus or minus 8% when compared to the same quarter for 2009 and 2010 (please see chart below). In general, our real estate market activity remains well below that of 2006 and 2007; however buyers with a five-plus year investment perspective are seizing attractive opportunities in the market every day.

We are now seeing more realistic sellers in the marketplace which may be a result of access to meaningful comparable sales in the market as well as many examples of over-priced homes. They may also be beginning to realize that time on the market is not on their side and that pricing decisions in the Alameda real estate market are paramount to achieving a times sale and maximizing proceeds. Statistics from the MLS confirm that homes on the market for more than 30 days sold on average for 89% of their original listing price; that is $110,000 under the original asking price on a million dollar home. Conversely, homes that sold in the first 30 days on the market sold on average for 98% of their original listing price.

Buyers in today’s marketplace are just as well educated and conversant about recent sales, price reductions, and new listing inventory as the seller’s. We find buyers to be generally patient, focused, seeking value, and not willing to make offers on overpriced listings. This makes the pool of qualified buyers keenly focused on the best-priced properties. Most buyers see their home purchase as a personal investment in their life style as opposed to an opportunity to speculate on an appreciating housing market and they are taking care to find both the right home and real value.

With micro-markets that are fare more robust than others, we see opportunity in the Bay Area real estate market every day for both buyers and sellers regardless of the volatile national and international news. We welcome the opportunity to visit with you about your specific needs, Alameda housing interests, or the real estate market in general.

Click the charts below to enlarge.